Category: Trends

How to Integrate AI Within your Startup: The Role of AI in Startup Growth

In the ever-evolving landscape of entrepreneurship, one question resonates loudly: Where does Artificial Intelligence (AI) belong within the heartbeat of a startup? Integrating AI within a startup’s framework holds immense potential for founders, offering opportunities to automate tasks, gain valuable insights through data analysis, and enhance engagement with customers and employees.

With labor shortages, high costs, and a fast-paced ecosystem, startups are encouraged to integrate AI to remain competitive and agile in today’s dynamic business environment.

Where could founders apply AI technologies within their startups?

Broadly speaking, AI can support three important business needs: automating business processes, generating new creations, and gaining insight through data analysis.

Automation of tasks

Every role has at least a few repetitive and manual tasks, such as checking emails, inputting data, and generating reports, that take away time from more impactful work. A McKinsey survey found that automation reduced costs by 10-15% and cut order processing time from 2-3 days to 1-2 hours.

In addition to that, a survey of 7,700 sales professionals from Salesforce found that sales representatives spend an average of less than 30% of their week on actual selling. Rather, much of their time is spent on manual tasks such as data entry and sharing updates on their deals in the pipeline. AI tools can help automate time-consuming tasks so sales representatives, as well as other employees, can free up time for more productive work while reducing the risk of human error.

“Our near-future plans in Flat6Labs include automating 80% of the filtration process for applications to our programs as our programs’ team receives thousands of applications,” says Shady Atef, Product & Tech Director at Flat6Labs. “It would be more efficient to focus most of their efforts on reviewing applications of higher quality and interviewing more serious applicants, rather than the process itself so that promising startups get the opportunity they deserve. This, however, still requires human supervision and upper hand in all cases, yet it would save a lot of time and effort for both our team and the startups who applied.”

Generating Content

At the heart of Generative AI lie massive databases of texts, images, code, and other data types. This data is fed into generational models that could use this data to create images, videos, 3D models, music, or text.

There are 2 types of Generative AI tools that benefit startups’ growth:

- Ready-to-launch tools:

Platforms like ChatGPT, Synthesia.io, and Google Gemini come pre-trained on vast datasets, allowing users to tap into their generative capabilities without building and training models from scratch. Startups can fine-tune these models with specific data, nudging them towards outputs tailored to particular business needs. However, these public options offer limited control, less customization of model behavior and outputs, and the potential for bias inherited from the pre-trained models.

- Custom-trained models:

Most organizations can’t produce or support AI without a strong partnership. Innovators who want custom AI can pick a “foundation model” like OpenAI’s GPT-3 or BERT and feed it their data. This personalized training sculpts the model into bespoke generative AI perfectly aligned with their business goals.

One of our portfolio companies in Egypt, Katteb, provides generative AI services in multiple languages where SMEs and copywriters can get instant articles and social media content that is fact-checked and ready to go live.

Analysis and Insights and Predictions

Ibrahim Ashqar, founder of Lumi AI, our portfolio company in UAE, mentions how AI tools provide insights and predictions to decision-makers in a way that has never been available before.

“Lumi AI democratizes the access to insights to people who aren’t technical,” says Ibrahim. “When an employee in any department doesn’t know how to code or manipulate data, they could use Lumi AI to ask the question in plain language and get insightful answers to help them in product designing, marketing, or any other field.”

This has been shown clearly with one of Lumi AI’s clients, a huge textile manufacturer who produces jeans and denim, and used to buy a lot of raw materials from a lot of different suppliers. When Lumi AI was connected to their database, within seconds the executive team found out that there are suppliers who are charging more for the same raw material compared to other suppliers. They were able to save around $600,000 based on these rapid and precise analytics.

Similarly, founders find MilkStraw extremely helpful. MilkStraw AI, our portfolio company in UAE, uses an AI model that integrates with a company’s infrastructure and comes up with recommendations to save them up to 75% on Cloud bills.

In addition, Digital First AI, our portfolio company in UAE, uses AI models to recommend the best marketing tactics for companies and SMEs based on their answers to a few questions about their business. It also provides access to a library of tactics where founders are able to view the strategies of popular brands and experienced marketers that the AI models were trained on.

How to find AI-skilled talents for your startup

As a startup founder, integrating AI into the company’s daily operations means hiring the right talent in each role. The right talent will use AI tools in their department to have the work done rapidly and efficiently. So, how could you know that your hire would utilize AI to the startup’s benefit?

“The most needed skills to look for in any hire are adaptability and resilience,” says Nour Mohieddine, our Talent Acquisition Manager at Flat6Labs. “In 2024, founders shouldn’t necessarily find employees with experience in utilizing AI tools, but rather look for ones who are willing to learn new ways to work and are flexible with new technologies. This way you guarantee that even the new technologies that are yet to emerge in the future will be embraced with open minds.”

Founders should use behavioral assessments to assess skills related to learning AI. These skills include:

- Resilience and adaptability

- Seeking lifelong learning

- Having a growth mindset, not a fixed one.

- The ability to thrive in a fast-paced environment

- Problem-solving

- Having a positive attitude ( to embrace the change)

Providing AI training within your startup

A recent study by the World Economic Forum shows that the cost of hiring a new worker can be as much as seven times that of upskilling an existing employee.

Founders who invest in AI training for themselves and their employees will have the opportunity to pioneer in their industry. An international survey by Boston Consulting Group found that while 86% of workers believed they would need training in AI, only 14% of front-line employees reported receiving any upskilling training. This gap presents an opportunity for startups looking to upscale.

If you are looking for intensive training, check the courses provided by eFlow, our portfolio company in Jordan. eFlow is a great learning platform for employees for different reasons:

- eFlow courses include Artificial Intelligence, Web 3.0, NFTs, digital literacy, and more.

- eFlow is an AI-powered platform, therefore, its expertise in AI is hands-on.

- eFlow offers 10-15 minute micro-courses in English, Arabic, French, and Spanish.

- Employees and learners could reach the educational content through Whatsapp, Telegram, Microsoft Teams, or Slack.

While going through the learning and development process for AI in your startup, consider the following topic to tackle:

- Integrating AI into existing processes

- Troubleshooting common AI issues/bugs

- Understanding of the concept of machine learning

- Familiarity and confidence with AI tools

- Crafting an effective ChatGPT prompt

- How to find guidance on AI

- Ethical considerations relating to AI

- The link between data, algorithms, and modeling

- Critical analysis of AI-generated responses

- Understanding the limitations of AI

- Selecting the right AI tool

Is your startup developing AI solutions?

AI is not a replacement for human talent. It only takes away the mundane tasks so humans could focus more on their growth.

As Shady Atef, our Product & Tech Director, mentioned; “Before the invention of washing machines, humans used to carry out laborious tasks just to get their clothes washed. The challenge of not having clean clothes was the main focus. Now that we have washing machines, humans could focus, not on the cleanliness of clothes, but on making them smell like roses and having them instantly steamed and ironed.”

If the founders and employees of a startup have more time to focus on new ways for the startup’s growth rather than on keeping it functional with the automatic and less creative tasks, one could only imagine which skies they would reach.

If your startup is developing tech solutions to modern challenges, check the open applications to Flat6Labs Programs in the MENA region, aiming to accelerate the growth and scalability of the startups that join. We curate our programs to suit the needs of the ever-evolving and innovative entrepreneurs who need our support to get what they need.

Note: Parts of this article were written with the help of AI tools to enhance efficiency and reflect the advancements in technology’s role in content creation.

Why Invest in Women in Tech? 7 Reasons Investors and VCs Shouldn’t Miss

It is not only about fighting gender discrimination.

When investors and VCs are confronted with the need to invest in women in tech, some may express their objectivity in their investment decisions, while others may interpret the call as addressing gender discrimination within the tech investment landscape.

The truth is, investing in women in tech is not only a call for inclusion. It is also an opportunity for investors and VCs that can lead to stronger portfolios.

Flat6Labs recognizes this opportunity and is committed to advancing gender inclusion through its investments. With nearly 80% of funding deals in 2023 directed to women-led tech startups, Flat6Labs shares reasons why VCs should back more women in tech.

Reasons Why Investors and VCs Should Invest in Women in Tech

1. Women-led startups generate more ROI

A study by BCG and MassChallenge found that women-led companies yield better returns on investment (ROI), generating 35% higher ROI than men-led companies. This is just one study out of dozens of other studies that reached the same conclusion; women founders outperformed their male peers.

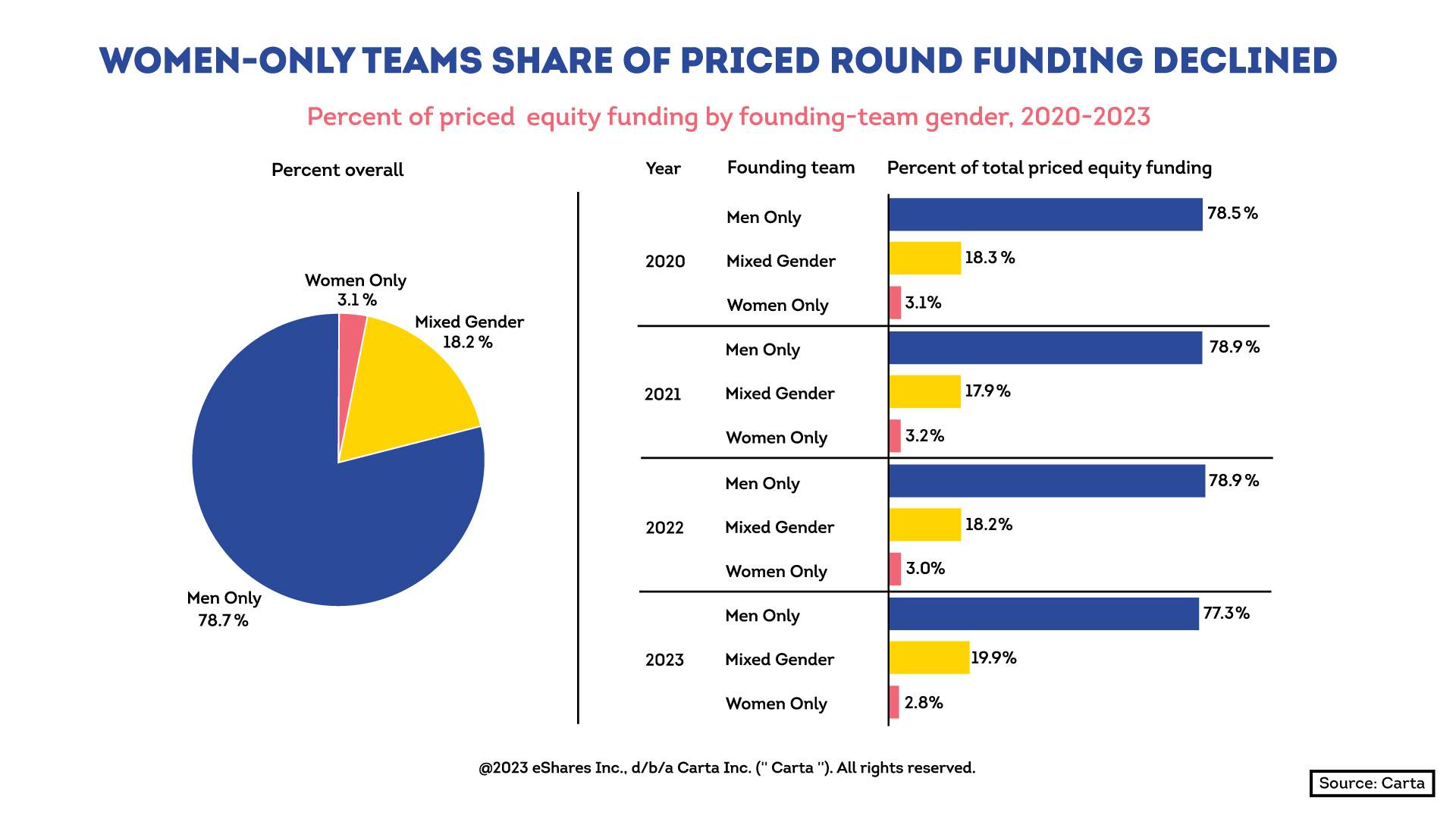

2. Women-led companies are underfunded

Despite the evidence that women-led startups outperform, women-led startups raised only 2.8% of all venture capital funding, according to Carta’s annual equity report of 2023.

Meanwhile, according to Startup Genome, 15% of tech startup founders are women, while about a third have at least one woman founder worldwide.

The gap is clearly shown as women represent a meaningful share of founders while having their startups underfunded nevertheless, presenting an opportunity for investors to take the lead and reduce the gap.

3. The stereotype against women in tech was based on a faulty study

In 1966, System Development Corporation (SDC), a computer software company based in Santa Monica, California, hired two psychologists, William M. Cannon and Dallas K. Perry, to develop a personality profile for programmers. The goal was to assist SDC’s recruiting process and enable the company to predict the best candidates.

According to Emma Jones, CEO of Project F, Cannon and Perry interviewed a predominantly male sample of engineers to develop this profile. Of the 1,400 engineers they interviewed, 1,200 (86%) were men. As a result, the profile they developed disproportionately identified men as ideal candidates for programming jobs and penalized extroverts and people who have empathy for others, traits that women were more likely to carry compared to men.

This faulty study has had a heavy influence on the industry, impacting how companies have viewed ‘ideal’ programmers and their recruitment practices for decades. Even today, we hear statements such as “women are not good with computers” or “STEM is for geeks”, which are misguided and reinforce biases that limit diversity and inclusion in the field.

4. Women founders are more likely to generate jobs for women

As Maya Oda Pacha, Investment Associate at Flat6Labs, mentioned, “Women founders tend to have more women employees hired at their startups, which contributes to reducing the gender inequality in employment.”

Flat6Labs investment data supports this observation. When we analyzed new jobs created by our portfolio companies between 2011 and 2023, we found that, among women-founded companies, 54% of new jobs went to women. This compares to 32% of new jobs going to women among the remainder of the portfolio.

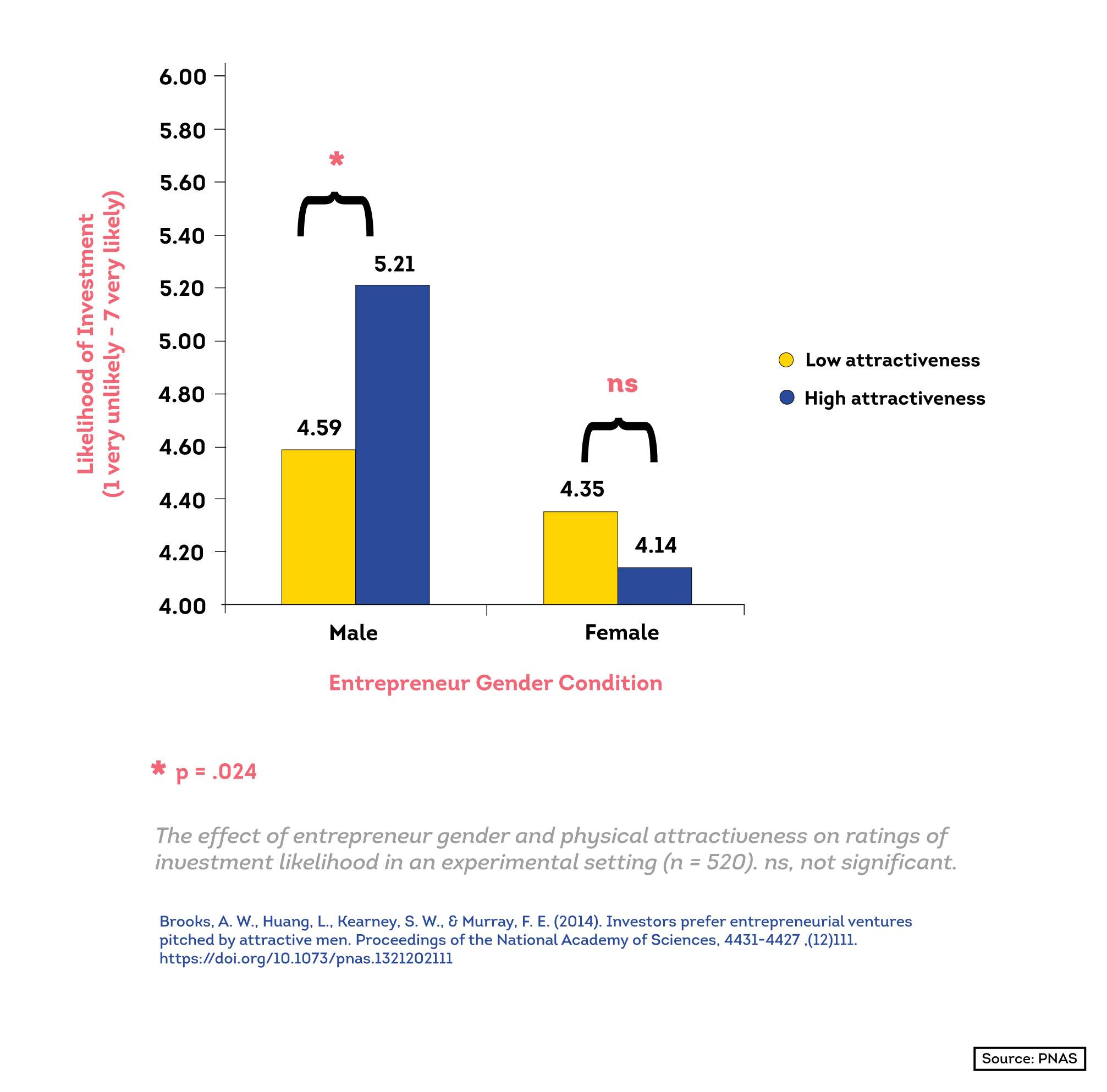

5. Bias can prevent us from backing investable women-led companies

In an experimental study by Alison Brooks and others that tests whether investors made decisions based on gender and attractiveness, investors were shown pitches with typical content and were asked to rate the probability of success for the pitches. Findings show that investors were more likely to to invest in attractive men (average score 5.21), followed by unattractive men (4.59), then unattractive women (4.35), and lastly attractive women (4.14).

To the extent that women entrepreneurs are disadvantaged in entrepreneurial pitching simply by virtue of their gender, then women may remain underrepresented in the entrepreneurial economy, despite their entrepreneurial abilities, because of internal bias.

As mentioned by Kristen Lee in Psychology Today, there is no such thing as an unbiased person. Although all humans have some sort of bias, investors and VCs ought to fight bias and prejudice as much as possible in order to reach wise decisions, because, despite the investors’ preferences for males in the experiment, women founders were factually the ones most likely to succeed in the previously-mentioned study by Alison Brooks and others.

6. Women entrepreneurs are likely to understand their customers

Even in tech industries that target women solely, women founders still receive less funding. In the Femtech industry that focuses on finding solutions for women’s health, male-founded startups raise much more capital than their female peers, with an average of $9.2m, compared to only $4.6m by women-founded Femtechs between 2018 and 2022.

So, with 70% of the Femtech startups founded by women and this significant lack of investment for them, there is more demand for investment than there is supply. This resembles the vast opportunity for investors to tap into an underserved market, yielding substantial returns and driving positive societal impact.

7. Those who are not enabled will never have the chance

A report shared in 2023 provided some shocking statistics, key findings included:

- 56% of women in tech are leaving their employers mid-career.

- Women leave the tech industry at a 45% higher rate than men.

- Only 24% of computing jobs are held by women.

With these numbers, one might consider that women are naturally not interested in/not suited for the tech industry. However, the same research showed that:

- In the tech industry, men are offered higher salaries than women for the same position 60% of the time.

- In 2016, women-led tech companies received $1.46 billion in investments from venture capitalists, while male-led companies received $58.2 billion.

- Computer code written by women was accepted 78.6% of the time on GitHub – 4% more than code written by men – when the coder’s gender was kept secret. However, when contributors are identifiable as male or female, men’s code is accepted at a higher rate.

Therefore, the reason why women are underrepresented in the tech industry is not due to their lack of experience but rather due to having fewer opportunities and not being equally enabled.

Opportunities For Women in Tech in The MENA Region

When asked about the opportunities for women in tech, Doaa Aref, Founder and CEO of our Egypt portfolio company Chefaa, explained, “Theoretically, opportunities in tech for women should be the same as for men.” She added, however, that women usually seek opportunities where gender-based rejection is less likely, “..This is an assumption they (women) may have due to societal pressure. This should be the core problem to solve.”

Consequently, moving towards minimizing the gender gap for founders in the MENA region, some programs are fully dedicated to supporting women-led startups, such as:

- Women’s Health Accelerator: The Women’s Health Accelerator Program, launched by Flat6Labs and Organon, aims to support mostly women-led startups that focus on enhancing women’s health and wellness across the MENAT region.

- She WINS: Flat6Labs partner, IFC, launched She WINS Arabia, a program that aims to help women-led startups across the Middle East and North Africa (MENA) get the advice, mentorship, and finance they need to grow.

Read more about global opportunities for women in tech on TechGuide.

Final Call to Invest in Women in Tech

Flat6Labs’ decade of experience shows how pivotal it is to invest in gender equality by investing in women founders and employees as well; having 51% of women employees and 50% of women at the leadership level at Fla6Labs has contributed to the company’s overall success.

“From that standpoint,” added Maya, “The world needs more women partners at the fund levels who could support female entrepreneurs and consequently support women employment because people tend to invest in people they identify with.”

Investing in women in tech is not just a matter of diversity and inclusion; it’s a strategic decision with benefits that investors and VCs shouldn’t overlook.

As evidenced by numerous studies and real-world examples, women-led startups outperform their male counterparts in terms of ROI and commitment to gender equality. However, despite these compelling reasons, women founders continue to face systemic biases and unequal opportunities.

We need to enable both men and women to reach their full entrepreneurial potential. Founders are not born, they are created, and general stereotypes and biases against women in tech have hindered the creation of talented leaders.

For more information regarding current opportunities for women in tech in Flat6Labs, visit: https://www.flat6labs.com/programs/

8 Best Tips From Our 8 StartSmart Webinars

Over the past few months, countries and regions have witnessed a global lockdown. While we were forced to stay home, we’ve decided to host eight webinars that would help the startup ecosystem and its key players take part in rebuilding it. This was done mainly through regional and global interviews with renowned investors & entrepreneurs, who have shed light on unique aspects of the COVID-19 pandemic and its regional & global impact on startups. We’ve decided to share them with you in a bite-sized article, with the eight best tips from our 8 #StartSmart Webinars.

“The pandemic heightens the need for inclusive services & products.” — Christopher Schroeder, a Global Investor

As we’ve all seen, this pandemic and the move to online communication, transactions, consultation, etc… has deepened the need for our economies to be inclusive of those who don’t have access to such technologies. Entrepreneurs should cease this opportunity to create solutions that bring inclusivity to a new level, Chris said.

Read more about our 1st Webinar here: “How to Take Off Your Startup During COVID-19 Outbreak”

“Startups In the Frontier Ecosystems Need to Think Globally.” — Alexandre (Alex) Lazarow, a global investor and author of “Out-Innovate.”

Alex elaborated that startups in growing economies need to think of how their startup can expand globally or regionally when they are just starting out. It is important to create a solution that could be adapted to different cultures and economies because it will facilitate your growth. He highlighted that most of today’s unicorns had going global at their core from the very beginning. Entrepreneurs need to think about how you can build teams that communicate efficiently across the world, and how they can build that global muscle from day one. Also, the pandemic is enabling entrepreneurs to reach out to global investors without the need to travel. This is a chance for them to raise money and approach remote investors.

Read more about our 2nd Webinar here: “How To Out-Innovate.”

“You don’t need to be in silicon valley to do something great.” — Amira Yahyaoui, MOS’ Founder

An entrepreneur should first and foremost be building for the experience, the journey, and changing people’s lives. Entrepreneurs need to realise that wherever they are in the world, there are problems that require innovative solutions, which will ultimately change people’s lives, hence, “you don’t need to be in silicon valley to do something great,” Amira said. She added” “the only interesting thing about silicon valley is the technology and the people,” and if you can read books, watch webinars, and listen to podcasts coming from the silicon valley, you can start anywhere.

Read more about our 3rd Webinar here: “Building a startup in Silicon Valley”

“Send consistent updates.” — Mike Preuss, Co-founder & CEO of Visible.vc

Mike said that in one of their surveys, they have discovered that founders are more likely to get investments if they are consistent with their reports to investors, in fact it increases their chances by %300. During the COVID-19, investors will likely be looking at startups that have a record of maintaining their reports. Most founders can’t raise because they don’t update investors regularly.

Read more about our 4th Webinar here: “Impactful Communication with Investors During COVID-19”

“If you want to see long term, positive change, you need to commit yourself to positive change.” — Roxanne Varza, Director of Station F

While the pandemic has held most of us hostage in our homes, it has provided an opportunity for the environment to get better. If we want it to keep getting better, we need to find solutions to do that, while still living our normal lives. COVID-19, on the good side of things, has provided us with a lot of opportunities that need to be explored by our aspiring entrepreneurs.

Read more about our 5th Webinar here: “Opportunities and Lessons Learned”

“Ask your customers/clients what they are doing, not what they need.” — Patrick Riley, CEO of the Global Accelerators Network (GAN)

Lots of businesses of varying sizes have changed their business models overnight to cope with pandemic, and all of them are dealing with new challenges. If you can ask them what they are doing, know the services they are offering, you can most definitely know & assume their challenges/problems, and develop/adapt your offerings to help them. Patrick added, “Your solution must always be relevant.” You can research different segments and find your “sweet spot,” and start developing a prototype or even launch a startup that is revolutionary, but no one wants because it is not relevant. When you start a research to create a product/service, think of how long it can stay relevant to people and businesses.

Read more about our 6th Webinar here: “Seed-stage Startups: A Global View”

“Find the right balance between human clustering and individual functions.” — Khaled Talhouni, Managing Partner of Nuwa Capital

Some tasks will require human clustering to be finished effectively, like creating a new innovative product/service. However, there will be tasks that require individual efforts, which could be done more productively from home. Startups need to find that balance between taking their jobs home, and clustering to innovate. Khaled Talhouni, Managing Partner of Nuwa Capital

Read more about our 7th Webinar here: “Building In the New Normal”

“Young entrepreneurs who have ideas should move ahead & do them.” — Ferid Belhaj, Vice President of World Bank MENA

Young entrepreneurs in MENA need to have the ambition to go way beyond what they think is possible because new tech must spread everywhere, Ferid said. He also noted that the market will judge the entrepreneurs’ projects, and whether it can absorb their products or not. Entrepreneurs need to do what they feel will work, and see for themselves if it actually solves the problem.

Read more about our 8th Webinar here: “The World Is A Village: World Bank Response to Covid-19”

The good thing about all these tips is that they are effective during the pandemic, post-pandemic, and in the face of any other economic recession. Make sure to utilise them to the best of your ability, and perhaps share it with your friends?

StartSmart 8th Webinar Recap: The World Is A Village: World Bank Response to Covid-19

On our eighth and last Flat6Labs StartSmart Webinar, we hosted Ferid Belhaj, Vice President of World Bank MENA, interviewed by Dina el-Shenoufy, Flat6Labs’ CIO to discuss World Bank’s response to COVID-19 globally and specifically in MENA. Ferid offered us his unique perspectives on how to tackle #COVID19, and how to create more opportunities for MENA startups. This is our full recap of the webinar.

“The world is a village”

Ferid said, one needs to find the right balance between squeezing out the best of the village that the world is becoming, and some of the possible negative aspects of this.

“Globalisation is fundamental”

Globalisation has helped us stay connected & work twice as much as we used to work from offices, and we need to push the globalisation of technology if a similar crisis ever comes to be, Ferid added.

“The World Bank has committed $160bn to MENA”

Since the crisis started, the World Bank committed $160bn to fast track financing facilities to help countries around the world to manage and deal with the health dimension of the crisis; to help the backbone of economies: SMEs; and to offer social protection for vulnerable people due to COVID-19.

“Young entrepreneurs who have ideas should move ahead & do them”

Young entrepreneurs in MENA need to have the ambition to go way beyond what they think is possible because new tech must spread everywhere, Ferid said. He also noted that the market will judge the entrepreneurs’ projects, and whether it can absorb their products or not. Entrepreneurs need to do what they feel will work, and see for themselves if it actually solves the problem.

“States in MENA need to be an enabler for startups”

“MENA needs to take care of itself,” Feird said. While we are trying to help countries, entrepreneurs and vulnerable families, states need to be the enabler that pushes everyone to do their best. States need to push out reforms that help startups. In some of Ferid’s talks with government officials from around MENA, they said that they are starting to recognise that they should have invested more in innovative solutions.

“Investment in new tech is never ever a lost investment”

Investors who have the resources and ability to invest in new technologies, need to be aware that it is their responsibility to help startups who are suffering because of the pandemic. They also need to be aware that an investment is never a lost investment, something will always come out of it; be it a new solution or a pivoted business model, something can always happen that can transform the way we live.

Make sure to join our upcoming Flat6Labs Cairo Spring 2020 Demo Day, June 24th. For more information and to register, click here.

StartSmart 7th Webinar Recap: Building In the New Normal

Our seventh Flat6Labs StartSmart Webinar was co-hosted by Khaled Talhouni from Nuwa Capital, with our own CEO, Ramez El-Serafy, to discuss the changing definition and implications of building companies and what this means for the MENA region

“Human clustering is a big part of accelerated innovation” — Khaled

Historically, Khaled said, that there has been a large dependence on human clustering to achieve innovation. It, as he said, plays a significant role as one of the economic engines. There is something about the existence of a people in a dense environment that cannot be replicated virtually.

“Find the right balance between human clustering and individual functions” — Khaled

Some tasks will require human clustering to be finished effectively, like creating a new innovative product/service. However, there will be tasks that require individual efforts, which could be done more productively from home. Startups need to find that balance between taking their jobs home, and clustering to innovate.

“Our region is super resilient” — Ramez

Over the past decade, we’ve seen and learnt how startups have been capable of surviving the many crises, Ramez said. Our applications during 2011 & 2012, have actually doubled every cycle, and that is a great indication of how crisis can breed innovative solutions, great adaptability, and resilience.

“Startups need to ask themselves what is different” — Ramez

During these times, startups will be either thinking about pivoting quickly to stay relevant, pushing forward with their existing solutions, or shutting down to cut the losses. Startups need to think about whether there is an actual opportunity to pivot, by changing their business model, creating partnerships, etc… They also need to think about how they can utilise their current solution to temporarily benefit from the situation. The crisis will end one day, so you as a startup founder, need to to think about your solutions and their viability in both the long and short term.

“There is going to be a shift in private capital” — Khaled

Businessmen will be looking for ways to invest their money in more transparent ecosystems, and they will head for micro investors and micro fund managers to take off the hassle of due diligence off of themselves. AngelList is the first iteration of that.

Make sure to join our upcoming Webinar on June 9th, 2020, Co-hosted by Ferid Belhaj of The World Bank MENA and our own Chief Investment Officer, Dina el-Shenoufy.

For more information and to register, click here.

StartSmart 6th Webinar Recap: Seed-stage Startups: A Global View

In our sixth Flat6Labs StartSmart Webinar, Patrick Riley, CEO of the Global Accelerators Network (GAN) shared his global insights on seed stage startups during and post COVID-19. Interviewed by Flat6Labs Beirut Managing Director, Fawzi Rahal, Patrick talked about the challenges and opportunities for startups to access the human and financial capital they need to solve problems and create impact during these challenging times.

“Acceleration doesn’t have to be in person.”

COVID-19 pandemic has proved that virtual acceleration is more than just possible. A testament to that is the number of accelerators in GAN, who have shifted virtualised their models. “The functions of an accelerator haven’t changed, but the mechanisms did change,” Patrick said.”

“Investors have the money.”

You need to prove to investors why your company is safe, stable, and most importantly, taking off during this season. Most investors nowadays think of whether they should wait for the storm to pass, or if they should doubledown on investments they have already made. In order for you as a startup to get their funds, you need to show growth, ability to scale, and high adaptability to COVID-19.

“Ask your customers/clients what they are doing, not what they need.”

Lots of businesses of varying sizes have changed their business models overnight to cope with pandemic, and all of them are dealing with new challenges. If you can ask them what they are doing, know the services they are offering, you can most definitely know & assume their challenges/problems, and develop/adapt your offerings to help them. Patrick added, “Your solution must always be relevant.” You can research different segments and find your “sweet spot,” and start developing a prototype or even launch a startup that is revolutionary, but no one wants because it is not relevant. When you start a research to create a product/service, think of how long it can stay relevant to people and businesses.

“5-year-old companies are the ones who will be creating jobs.”

With many companies laying off people due the COVID-19 pandemic, the unemployment rates have skyrocketed in the past months across the globe, but startups, as always, can flatten the curve. Patrick said that according to their surveys and research that companies that are 5-year-old or less are capable of creating new jobs much more than 6+ year-old startups.

“You are not your business.”

The most successful entrepreneurs and founders didn’t make it from the get-go, some had to struggle a bit to finally create that one innovative solution that is bound to change the world. Failing at one venture, two, or three doesn’t make you a failure. Learning when to quit, pivot, or try something entirely new is what shows your strength and resolve.

“There is something about real life interaction that virtualness cannot replicate.”

Partick has elaborated that now might not be the best of times to find a co-founder for your startup, and that you need to do it in real life because you get to know that person in front of you when you do that.

“If you don’t know where you are going, any road will take you there.”

Tell your team where you are going today, and be flexible enough to adapt & change your plans next week if necessary, but know that in the end you will get “there.”

Read Patrick’s recommended blogpost entitled “The One Chart That Gets Me Up In The Morning.”

Make sure to join our upcoming Webinar on June 2nd, 2020, Co-hosted by Ramez El-Serafy, CEO of Flat6Labs, and Khaled Talhouni, Managing Director of Nuwa Capital. For more information and to register, click here.

StartSmart 5th Webinar Recap: COVID-19: Opportunities and Lessons Learned

In our fifth Flat6Labs StartSmart Webinar, Roxanne Varza, Director of Station F exposed what the COVID-19 pandemic offered and still has to offer to startups in general, no matter where they are: MENA, Europe or US. This crisis is changing the landscape of the startup and tech ecosystem, and Roxanne & Faten Aissi Flat6Labs Tunis Marketing & Outreach Manager discussed the lessons learned and how innovation tackled some of the most severe aspects of the quarantine in Health, entertainment, WFH and education.

Take advantage of talents that have been laid off around the world

Due to the current economic crisis, many startups and corporates are laying off people to maximise the business’ chance of surviving the economic recession. So they are laying off people, this is where if you as someone just starting out or your business is growing rapidly can utilise this chance to hire remote employees. This is an opportunity for you because you can get a magnitude of experienced people, who can help your business grow and scale, remotely.

Customer service is essential the more you grow

Understanding that your small team will not be capable of always answering questions, receiving complaints, or following up with magnitude of people is important to knowing when to outsource your customer service or build a team dedicated to just that.

Companies needn’t be ashamed of downsizing, but someone needs to take responsibility

During the pandemic, many companies went the route of laying off people, but taking responsibility for your business operations, means that you care for business, your clients, and your staff. People can grasp the reality they are in, but they need to be assured that they were worth every resource the company has put into hiring, training, and employing them. It is more than just a nice gesture or politics, it is honest and responsible.

If we want to see long term, positive change, we actually need to commit ourselves to positive change

While the pandemic has held most of us hostage in our homes, it has provided an opportunity for the environment to get better. If we want it to keep getting better, we need to find solutions to do that, while still living our normal lives. COVID-19, on the good side of things, has provided us with a lot of opportunities that need to be explored by our aspiring entrepreneurs.

Always be dedicated & focused

If you start something, finish it. Don’t get sidetracked, Work until your vision has become your reality, but until then, keep your focus on one project at, one startup at a time.

Make sure to join our upcoming Webinar on May 19th, 2020 with Patrick Riley, CEO of Global Accelerator Network along with Fawzi Rahal, Managing Director of Flat6Labs Beirut. For more information and to register, click here.

StartSmart 4th Webinar Recap: Impactful Communication with Investors During COVID-19

In our fourth Flat6Labs StartSmart Webinar, Mike Preuss, Co-founder & CEO of Visible.vc along with Marie Therese Fam, Managing Partner of Flat6Labs Cairo, discussed how startups can approach investors virtually but effectively during the pandemic. Mike and Marie highlighted how you can leverage KPSIs and metrics to win over investors, and how it is virtually possible to communicate all of that online.

Cash Has Never Been More King than today

How you will be managing your burn rate in the upcoming months is much more important than how much you are growing nowadays. Investors will be looking at your ability to to maintain cash flow, while still running your business, Mike said.

Send consistent updates

Mike said that in one of their surveys, they have discovered that founders are more likely to get investments if they are consistent with their reports to investors, in fact it increases their chances by %300. During the COVID-19, investors will likely be looking at startups that has a record of maintaining their reports. Most founders can’t raise because they don’t update investors regularly.

Where You See Failure, Investors See Opportunities

From developing multiple relationships with startups and funding many, investors develop this pattern and skill to recognise troubles and opportunities. If an investor sees that your metrics haven’t been met for this month, they might consider funding you or providing you with the resources to help further grow your business. Don’t fall short on sending your reports as much as your investors want, and compare on a month to month basis.

Consistence Cadence Will Help Your Investors Fully Trust you

Instead of micromanaging you into sending reports, setting clear KPIs, and metrics, or having unreasonable demands of you because they don’t really understand the nature of your workflow, you will give them what they want beforehand, so that automatically stops you from getting innumerous requests. In the eyes of the investor, you are an active and an engaged entrepreneur. Consistent cadence also gives you time to reflect on your operations, and what needs to be done or changed.

If You Don’t Need The Money, Don’t Raise The Money

Some bad investors will be looking out to getting the maximum out of your business for little change. You have to be careful while choosing your investors during the COVID-19 pandemic, and if you can maintain your position in the market and operations, then there is no need for it.

Make sure to join our upcoming Webinar on May 5th, 2020 with Roxanne Varza, Director of Station F along with Faten Aissi, Marketing & Outreach Manager of Flat6Labs Tunis. For more information and to register, click here.

StartSmart 3rd Webinar Recap: Building a startup in Silicon Valley

In the third webinar of the StartSmart Webinar Series, Amira Yahyaoui founder of MOS, a Silicon Valley based startup, and Tarek Chelifah, Flat6Labs Tunis Senior Program Manager, discussed what it is like to build up a startup in Silicon Valley and how it compares to building one in MENA. Here is the quick recap.

“You don’t need to be in silicon valley to do something great”

To Amira, an entrepreneur should first and foremost be building for the experience, the journey, and changing people’s lives. Entrepreneurs need to realise that wherever they are in the world there are problems that require innovative solutions, which will ultimately change people’s lives, hence, “you don’t need to be in silicon valley to do something great,” Amira said. She added” “the only interesting thing about silicon valley is the technology and the people,” and if you can read books, watch webinars, and listen to podcasts coming from the silicon valley, you can start anywhere.

“Don’t think of just your country, think regionally”

Entrepreneurs are always caught up in building startups with a focus on the local market, but if we try to look for differences between the Egyptian and Bahraini market, we won’t find many. At the very core, our cultures, markets, and purchasing powers are very similar. So “don’t think of just your country, think regionally.”

“Failure is loved cherished, and accepted in Silicon Valley”

One of the things that Amira highlighted was that people in Silicon Valley seem to be very resilient, hardworking, unshaken by fear of failure, and are risk-takers. ‘“Failure is loved, cherished, and accepted in Silicon Valley” because you learn from it, and investors look for people who are hardworking, passionate, and experienced. we won’t find many.

“I believe so much in hunger & scarcity to build”

Amira believes that being an entrepreneur means that you can do lots of things with limited resources. Get creative with the resources you have, and utilise everything you have to its maximum potential. “You cannot build anything in silicon valley if you are not willing to work hard,” Amira said.

“To get to Series A you need to show a considerable spike in the number of users/clients”

After getting your seed fund, don’t expect investors to be encouraged to invest in your startup if you haven’t had a considerable spike in the number of clients/users/customers. This is what investors in Silicon Valley look for, they want to see that your solution is in demand because if it is not, they will not invest. A product/solution is only great if people need it.

“Find people who fit your company culture”

“Find people who fit your company culture,” Amira advised. No matter how much you believe in hiring people with different backgrounds and personalities, working with people who are naturally aligned with your company values, ethics, and goals will get you the best results and it will help your startup grow tremendously. Hire people you want to work with!

If you have any questions, you can reach Amira on any of her social media accounts using @mira404.

Make sure to join our upcoming Webinar on April 28th with Mike Preuss, Co-founder & CEO of Visible.vc along with Marie Therese Fam, Managing Partner of Flat6Labs Cairo. For more information and to register, click here.

How Flat6Labs Startups Are Mitigating the COVID-19 Outbreak Hurdles

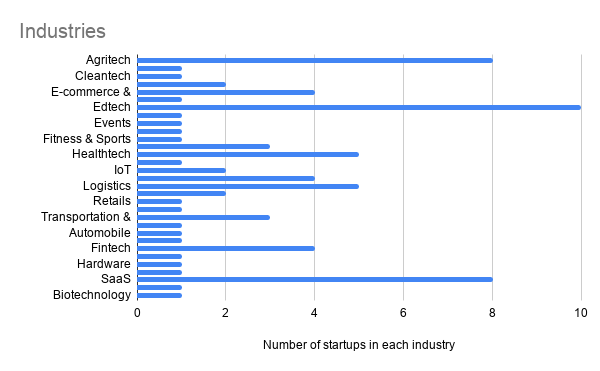

During this pandemic, some industries will grow exponentially, while others will struggle to stay afloat. We set out on surveying a sample of 80 active startups to observe how our founders are maneuvering the pandemic, what is needed for survival and for continued growth and scalability, and how should the founders capitalise on the current situation to maximise their revenues, raise their brand awareness, and develop new products and services.

Our startups are in the edtech, agritech, healthtech, logistics, fintech, IT, transportation & travel, and SaaS industries, and it has been noticed that those whose business models depended heavily on legwork (the physical presence of someone on the job), have either shifted their operations completely online, halted their operations for the time being, or continued operating normally due to the nature of the business model that allows them to do so (for example: the delivery of essential products such as medicine, food, water, & sanitary).

52.6% of the startups surveyed required legwork, and as previously mentioned, were the startups majorly affected by the outbreak, whereas the 46.2% percent that didn’t depend on legwork at all, seem to be either operating normally or their businesses are booming.

With around 61% (49 startups) of the startups sampled not operating normally, approximately 81% (40 startups of the 49 startups) have already devised plans, strategies, and even new business models that allow them to adapt to pandemic, which will be discussed shortly. These startups are in the transportation, travel, agritech, logistics.

The rest of the startups are either operating normally or beyond normal capacity because of the pandemic, and they are in the Edtech, SaaS,

The rest of the startups are either operating normally or beyond normal capacity because of the pandemic, and they are in the Edtech, SaaS, Fintech, E-Commerce, and IT industries.

Industry Breakdown

Agritech

Around 62% of the startups in agritech require legwork, this is because the nature of the job itself demands the installation and maintenance of tech equipment that aid and makes their processes more efficient. Hence their ability to work at normal capacity is affected.

LifeLab Biodesign (Flat6Labs Beirut): They are delaying the legwork farther into the process until the lockdown is lifted. LifeLab designs and deploys fully-automated, climate-controlled vertical indoor farming technologies.

IoTree (Flat6Labs Beirut): They are currently pushing out new features into their already installed products/services to be capable of retaining clients after the outbreak. IoTree is a wireless sensory network of smart traps that are developed using a deep learning algorithm for the early detection of harmful pests and insects in farms.

Conative Labs (Flat6Labs Cairo): They are rescheduling deliveries and dividing the teams so that the workplace isn’t congested. An IoT-enabled water quality monitoring and alarming system for aquaculture.

The plans that they both have devised seem to be common across many of the agritech startups at the moment, and are helping them mitigate the situation.

Healthtech

The results of the healthtech industry were inconclusive, as our startups have very different business models, and most of them require legwork (60%).

Chefaa & Pharmaklik (Flat6Labs Cairo & Beirut): It is important to note that although legwork was required, some businesses weren’t incapcitated by it as they use delivery services to bring medicine to homes. Chefaa, a Flat6Labs Cairo startup, and Pharmaklik, a Flat6Labs Beirut startup, are examples of startups doing well because of the service they provide. Chefaa have also added a new application feature that allows customers to know all about the latest updates of the COVID-19.

MedMisr (Flat6Labs Cairo): They are offering their services at discounted rates. MedMisr is a digital third party administrator providing medical insurance companies an innovative online paper-free solution with fraud controls.

Logistics, Travel, & Transport

Transportation (e.g. ride-hailing), automobile and travel booking platforms have been reported as one of the most “at risk” industries — however, should some startups adapt to the current changes in customer preferences and consider instead the delivery of groceries or medical supplies, they may have a more sustainable business while ensuring they take their customers best interest into consideration (quality and price-wise).

Transpooler (Flat6Labs Cairo): They are considering using their transport tech platform to cater to a different sector (previously students) which would utilize their services more, while managing their expectations it will be still be difficult to acquire customers and convince them to use the platform. Transpooler helps schools and nurseries to monitor their fleet service and offer parents and students live tracking, speed monitoring and chatting.

Wantotrip (Flat6Labs Tunis): They have convinced their travel customers to retain the amount they already paid as credit for future trips (rather than refund) in an attempt to keep their customers on their platform and utilize it once they’re able to travel again. Wantotrip is an international travel platform offering authentic and themed travel packages around the world for communities or individuals.

Shabeb Delivery (a Presentail company) & Hommy Cook (Flat6Labs Beirut & Bahrain): Startups in the logistics industry with a focus on food delivery seem to be doing exceptionally because of the rising need for distancing and having a contactless life during this period. Shabeb is a quick last-mile delivery service for your business, they have also collaborated with the lebanese food back to deliver food to unfortunate families’ doorstep. With the press of a button, we’re at your door in minutes. Hommy Cook helps cooks make money by selling their home cooked food to thousands of customers through Hommycook.

Hovo (Flat6Labs Cairo): They are using the current period as an opportunity to raise brand awareness and have an increased community involvement. They are buying essentials for the elderly and vulnerable families and delivering it to their doorstep. HOVO is a tech-enabled logistics partner that provides trucks in 20 mins across Egypt.

SaaS & IT

Since almost everyone is, at the moment, dependent on online management tools and services that make work life seamless, it was imperative to see that SaaS startups are doing well and even exceeding expectations. In regards to IT, startups were mostly doing well without any legwork, however, some startups that dedicated their services to restaurants for example, weren’t doing that great.

Untap (Flat6Labs Cairo): Untap is collaborating with high profile companies to manage competitions such as organizing an online regional hackathon for Dubai Future Foundation. They have also launched One Million Arab Coders initiative to find solutions to the challenges posed by COVID-19. Untap is a submission management system used by organizations to easily launch and manage online prize-based competitions and calls for applications.

Nural Technologies (Flat6Labs Bahrain): This startup built around the idea of online management of teams and tasks seem to be doing exceptionally well during this period without much required adaptation.

E-Robot (Flat6Labs Tunis): Have shifted most of the engineers work online. E-robot Software develops IT automation solutions to create web and mobile applications without code writing.

Fintech

It is normal to see that the Fintech industry is booming during the pandemic, this is largely due to people seeking safer alternatives to banknotes. In fact, some governments are adapting that kind of technology into the national banks. There was one drawback anyhow, which is financial inclusion. Around 25% of the startups that had its primary focus on financial inclusion through their services are operating below normal capacity. It is important to highlight this shift in the industry trend because during these times, it is even more important to find a way to get to those who are unbanked.

Juno (Flat6Labs Beirut): This startup is targeting the unbanked population and has moved most of its operations online, but they are facing difficulties reaching potential customers. Juno digitizes banking focusing on simplicity and personalization to provide financial services.

-Edtech

It’s no surprise that the outbreak will dramatically transform the global higher education sector creating a new normal for how courses will be taught moving forward; in short, it will revolutionize the online learning landscape which can translate to potentially successful ventures for startups in the Edutech industry.

GoMyCode (Flat6Labs Tunis): GoMyCode has already started adapting by selling online via Facebook and decided to kick off their e-learning platform in the coming few days instead of this September as planned. In an effort to popularize their brand and attain their customers, their platform will be temporarily for free and they managed to also create a community of teachers who will be volunteering. GoMyCode is High-end computer Science Education startup with a unique learning experience that leaves lasting impressions and positively impact our students’ lives.

Spica Tech (Flat6Labs Beirut): Spica Tech has started building an online community surrounding their students where they can share their learnings and progress on the online coding and storytelling program available on the platform — which has been since heavily promoted in order to offset offline learning that some of the students were accustomed to. Spica Tech academy teach kids (5+) and teenagers game development as a way to reshape Science, Technology, Engineering, Arts and Math.

On a regional scale, it has been reported that startups which rely more on legwork are facing increased difficulties managing their business, as well as shifting to the digital landscape since they’re not acquiring enough subscriptions or having sufficient equipment essential for creating content.

E-commerce & Shopping

Cleaning supplies, personal hygiene, supplements among others that the everyday consuIt’s no surprise that the startups that are most likely thriving nowadays are e-commerce platforms where they provide and deliver everyday necessities, from products ranging from healthy snacks,mer will find beneficial in order to combat the new “normal” lifestyle they’re leading today.

Mint Basil Market (Flat6Labs Beirut): This startup is focusing on products that their customers will continue to value in the months to come, and they have been lately adding a new immunity boosting collection of products, ensuring that their platform will be able to fulfill the needs of those who are navigating towards a more healthy lifestyle from the comfort of their home since they also include free delivery (while taking the vital safety precautions). Mint Basil Market is an e-commerce platform that offers a wide range of healthy, natural products, from food to cosmetics, and which can be delivered straight to people’s doors.

SeekMake (Flat6Labs Tunis): In order to help the doctors who are facing the COVID-19 pandemic in Tunis, Seekmake has mass produced masks to help protect frontline doctors who are dealing with the pandemic daily. SeekMake is a marketplace linking CNC, laser machines and 3D printer owners with designers and end users.

Dabchy (Flat6Labs Tunis): A Flat6Labs Tunis startup is increasing their marketing efforts to maintain their involvement in communities by pushing out empathetic messages. They are aiming to reach more people by opting for more ads and less organic content in this period of declining sales and unengaged people. Dabchy is a women marketplace that allows women to revamp their wardrobes easily: they can earn money by selling their used clothing online, buy other clothes at discount prices and share their personal style.

Startups that have a B2B business model or B2C but provide non-essential products and services, such as clothing, jewelry and the like, won’t find success since their customers buying power is on an all- time low for luxury products instead shifting their preferences to food, vitamins, everyday home essentials, sanitary products, among other items that will need to constantly purchase for an unpredicted time frame. An additional problem for these startups is that should they decide to promote their businesses, they can come across as tone-deaf to the financial situations of their audience — it’s increasingly challenging for them to keep their business afloat while retaining the praise of their customers simultaneously. However, the silver lining is that some startups can find success should they be able to pivot by changing their business model to selling products that people can benefit from during their home quarantine (such as home gym equipment, books, toys and games).

Our main takeaways

The industries most negatively affected by this phenomenon were: transportation, travel, agritech, & logistics. On the other side of the coin Edtech, SaaS, Fintech, E-Commerce, & IT seem to be doing relatively well.

For all of the startups, it is highly advised that you begin looking for cash & funding, and cutting down costs without affecting the operations of your businesses. It is also important to start working on research and development, perhaps even pivoting to accommodate the current needs of the market.

When it comes to marketing and sales, if you can’t see your startup being of any help to the people, work on raising brand awareness but be sensitive to other people’s pains. It is due time for some good CSR. Also, a good strategy moving forward with your sales is to offer people discounts, giveaways, and free services in return for their loyalty, and sell (mostly) the things that they need the most at the moment.

It is also a good opportunity for startups to start going online, find a way to make their business become mostly cloud-based. If you can do that, you can truly future-proof your startup.

Check our #StartSmart Webinar recaps:

–“How to Take Off Your Startup During COVID-19” here.

–“How to Out-Innovate” here.