Month: April 2022

Survey Results: Key Insights About the Startup Ecosystem in KSA

Over the past few months, we conducted a survey to gain more insight about Saudi startups, including early-stage funding, specifically pre-seed funding, as well as the overall challenges facing the entrepreneurship ecosystem in KSA.

We gathered the responses of 100+ full-time startup founders in KSA, who shared their diverse experiences and perceptions throughout their entrepreneurial journey, and reached the following summary:

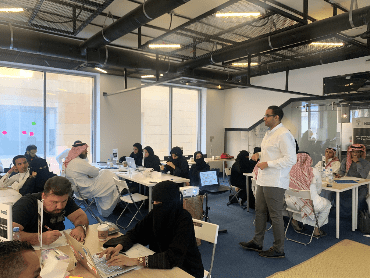

Challenges facing entrepreneurs:

Among the many challenges that founders face, is the difficulty of securing the capital required to establish a startup in KSA. About 50% of the respondents were unable to raise funds or finance their startups through independent parties. Instead, they relied on their own funds and support from family members.

In addition to the high operating expenses, 50%+ of the startups, in the case that they actually succeed in securing funding, manage to secure no more than SAR 375,000. This amount isn’t sufficient in financing the operations of any business for more than five months. Based on our estimations, such an amount would often be sufficient to cover business operations for only 3-5 months.

It is worth noting that 17.2% of the participants managed to secure more than SAR 3 million in funding, notwithstanding the limited resources and funding amounts available to most participants. This may indicate that funding opportunities are only focused on some specific sectors.

The scarcity of qualified talent for reasonable wages can also be placed at the forefront of the challenges facing startup founders in KSA, where 23.8% of respondents expressed that they are experiencing difficulty in recruiting talent with the funding cap available.

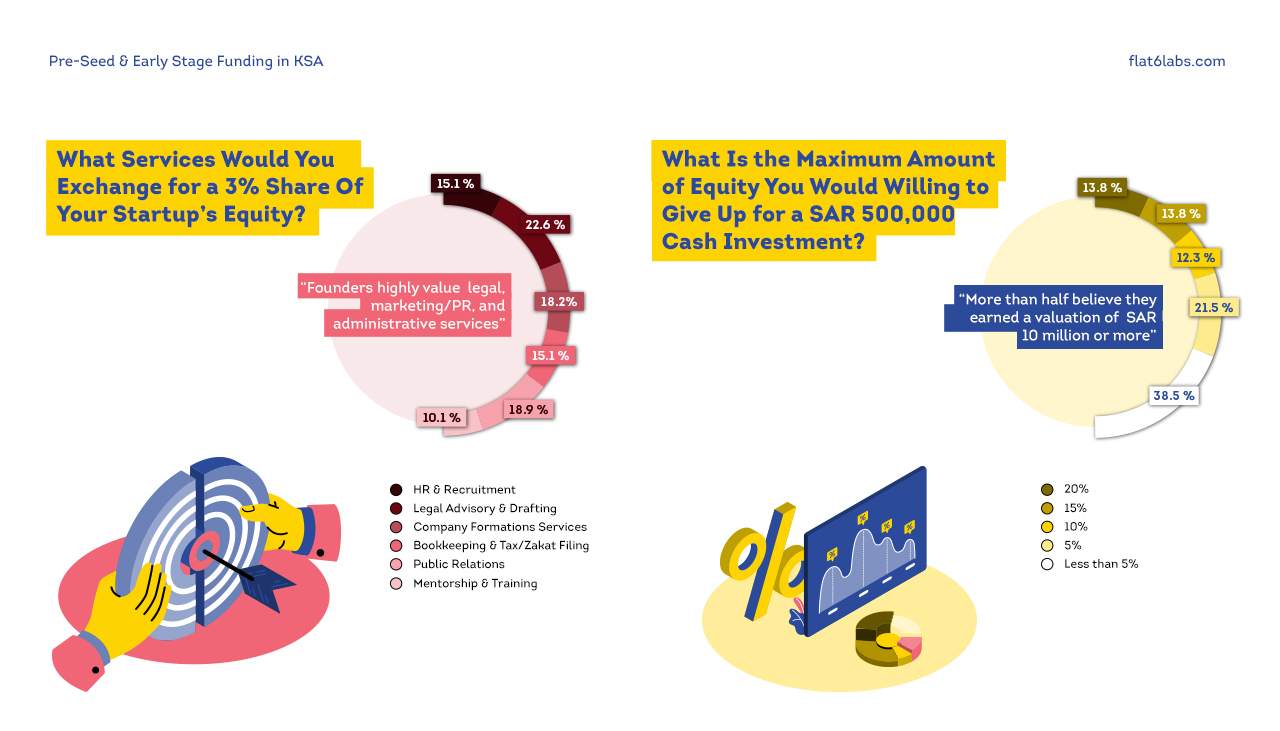

Furthermore, approximately 17% of the entrepreneurs participating in the survey have highlighted another challenge, mainly the statutory fees and requirements imposed by legislative bodies and authorities in order for them to be able to launch their businesses within a legal framework, which limits the opportunities for some startups. It is also worth noting that 40%+ of respondents cited legal, regulatory and PR services as an alternative to cash funding, in return for 3% of equity.

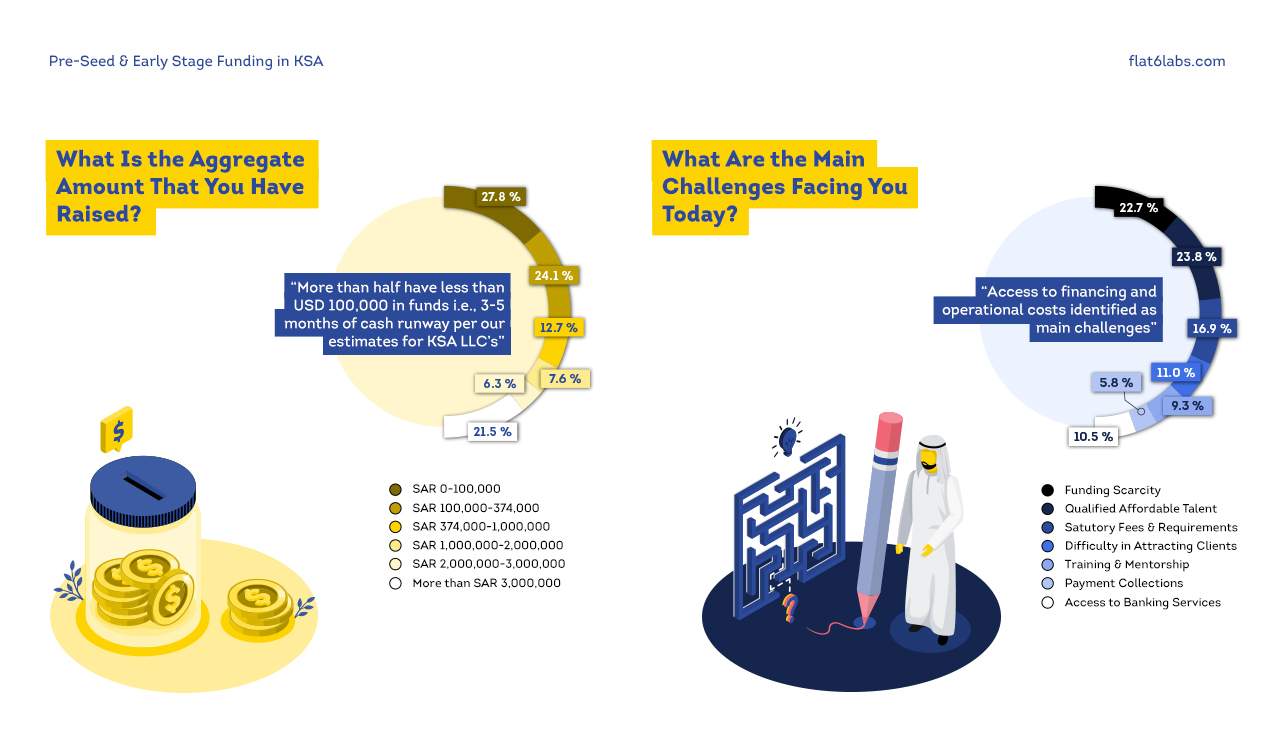

Funding Sources Available:

Due to the scarcity of funding sources for startups, self-funding is the most common source of pre-seed funding, which 30% of startup founders relied on. Angel investors rank first among independent sources of seed funding, at 15%, among other various independent sources that the founders often resort to at the beginning of their journey, such as business accelerators, venture capital funds, etc.

Startup Age:

According to the founders participating in the survey, one third of startups were founded within the past year, representing a positive reflection of the economic landscape in KSA, following the repercussions of COVID-19.

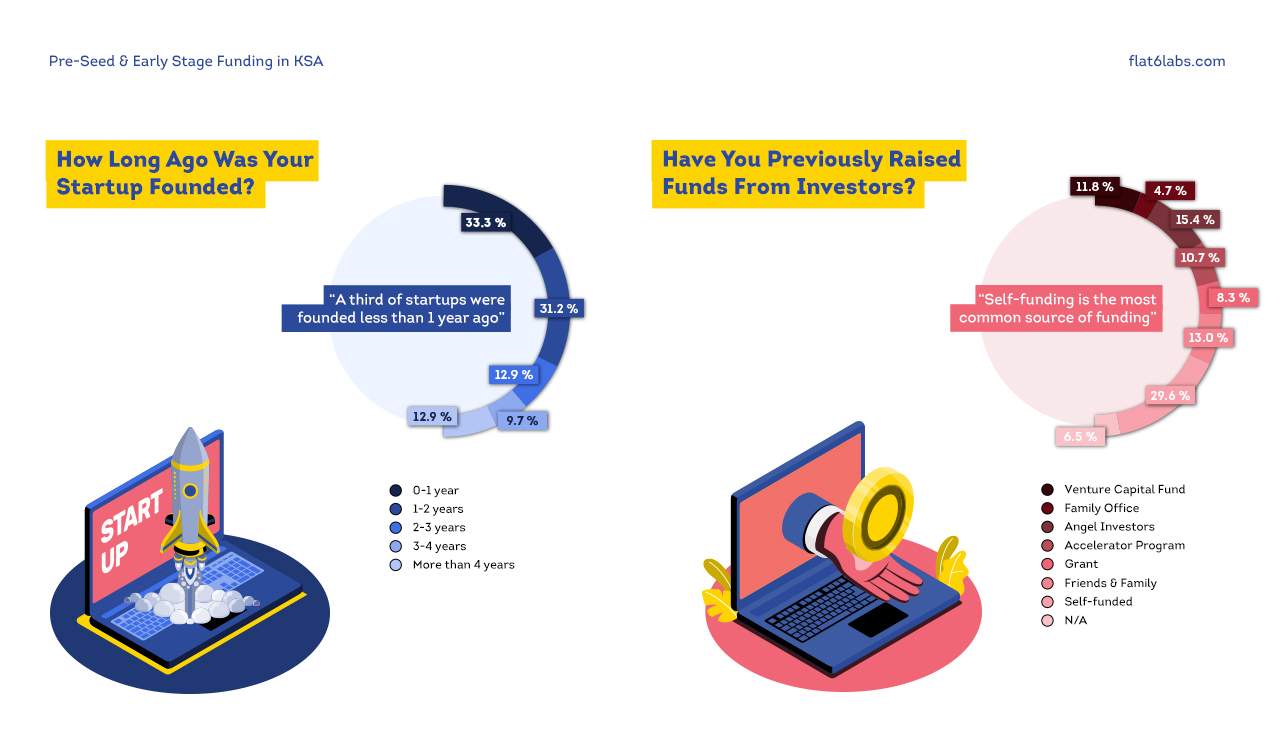

Product Readiness:

50%+ of the participating founders have developed and launched products that are customer ready with more than one third of the startups having generated sales upon introducing their products to the market. Moreover, 17% of the businesses managed to generate sales exceeding 1 million Saudi riyals within the past year.

Preliminary Assessment:

More than half of the respondents believe that their startups are worth SAR 10 million or more, and noted that they may be willing to give up only 5% of equity against SAR 500,000.

Looking to apply to our Riyadh Seed Program? Applications are open here.

The Saudi Venture Capital Company (SVC) and Flat6Labs launch the “Startups Seed Fund” and Flat6Labs Riyadh Seed Program

Saudi Venture Capital (SVC), one of the most prominent venture investment ecosystem development companies in KSA, has signed a new investment agreement with Flat6Labs, the leading seed and early-stage venture capital firm in the MENA region, to introduce the “Startup Seed Fund”. The fund aims to support startups with growth potential and provide more than 20 Saudi startups annually with seed capital over the next three years, in addition to a number of other benefits.

BLOMINVEST, one of the leading investment management companies in the region, will manage the distribution and marketing of the “Startup Seed Fund” as it will be the exclusive partner for marketing the fund’s units in Saudi Arabia and raise up to SAR 150 million, within 12 months starting from the fund’s launch. The fund will adopt a highly diversified systematic investment plan that aims to reduce the risks faced by VCs along with the administrative and legal costs faced by startups at early stages. The fund is also designed to provide support and investment in Saudi startups, provide various ways to support innovation, and create space for pioneering Saudi youth to develop their technology startups and expand their scope in the region.

The fund’s size is SAR 150 million and is allocated for the investment of early-stage startups operating in the technology and innovation sectors within KSA. The investment provided to companies will range between SAR 937,500 to 1,500,000 per company, as well as follow-on funding that will enable companies to complete their expansion inside and outside KSA.

In addition to the cash investment, the fund offers the Flat6Labs Riyadh Seed Program, which is a 4-month seed program held twice a year for over a span of 3 year. The program will support entrepreneurs to develop their business skills and provide them with a supportive environment to build their products, test market fit, improve their business models, and pitch to external investors; the program’s first cycle is expected to be held in the beginning of the third quarter.

Dr. Nabeel Koshak, CEO of SVC, stated: Our investment in the ‘Startup Seed Fund’ with Flat6Labs is a part of SVC’s implementation strategy to launch the “Investment in Accelerator and Startup Studio Funds” product, this partnership is built to enhance the creation of high-growth startups and to support the investment in their seed and pre-seed stages. This product was developed to foster the growth of the venture capital ecosystem in Saudi Arabia at all stages, in an effort to fill a funding gap that resulted from the focus of venture capital funds and angel investors on investments beyond the seed stage.

The fund aims to support more than 180 entrepreneurs, create more than 6,000 jobs in the private sector of KSA, and enable Saudi companies to expand in the region through the Flat6Labs regional offices. It will contribute to completing the structural transformation process that KSA aspires to by increasing the digital economy’s share of GDP and enhancing the contribution of the non-oil private sector.

Ramez El Serafy, CEO of Flat6Labs, added: “We are pleased to provide investment opportunities to early stage startups based in KSA, which constitute the cornerstone of the private sector in KSA. We look forward to launching the Flat6Labs Riyadh Seed Program, a program dedicated exclusively to accelerating the economic transformation in KSA, being the location of our first regional expansion out of Egypt. We are proud to transfer Flat6Labs knowledge of initial investments and seed programs to our team in KSA led by Eyad Albayouk, our General Manager in KSA, and Lujain Nassif, our Program Director in KSA. We also look forward to strengthening the team in KSA with more young Saudi talents.”

Apply to Riyadh Seed Program by clicking here.