Month: February 2024

Organon and Flat6Labs Announce Second Cycle of Women’s Health Accelerator Program, Expanding Focus to Address Key Women’s Health Challenges Across MENAT

Celebrating International Women’s Day: Empowering Female-Led Innovation in Healthcare

Dubai, United Arab Emirates – 29 February 2024: Organon, a global healthcare company dedicated to improving women’s health, in partnership with Flat6Labs, MENA’s leading seed and early-stage venture capital firm, is thrilled to announce the launch of the second cycle of the Women’s Health Accelerator Program. Building on the success of the inaugural cycle and the incredible momentum witnessed across the region, this initiative aims to empower digital health startups with solutions to enhance women’s health across the Middle East, North Africa, and Turkey (MENAT) region.

The second cycle will hone in on three main focus sectors critical to women’s health:

Family Planning: Technologies Enhancing Contraception Counseling and Education and Awareness of Tools and Options.

Fertility Planning: Solutions for IVF Mental Health Support and Counseling.

Women’s Wellness: Innovations in Self & Maternal Care, Disease Prevention, and Menstrual Health.

The overarching objective of this accelerator program is to address specific challenges faced by women in the region concerning their health, aiming to find sustainable and long-term solutions. The focus will be on identifying and supporting digital solutions that can help improve accessibility, empower individuals, and enhance overall quality of well-being, ultimately advancing women’s healthcare in the areas identified. This year’s program will target startups operating in several countries, including Kuwait, Lebanon, Oman, Turkey, Egypt, Jordan, KSA, and the UAE. The majority of these countries have established Organon & Flat6Labs offices, with both entities having local partners in these geographies.

The initiative aims to accelerate the growth of 15 startups, and engage with various stakeholders, ultimately graduating startups that are ready to launch and address current challenges in women’s health. Additionally, the program will include virtual and on-ground community events such as info sessions, roadshows, pitchathons, and webinars to strengthen outreach, scouting, and selection efforts.

The second cycle of the Women’s Health Accelerator Program introduces enhanced program offerings. These offerings include:

In-Depth Training: Startups will receive specialized training in business and technical aspects, equipping them with the knowledge and skills necessary for success.

Mentorship and Guidance: Participants will benefit from mentorship provided by industry experts, connecting them to a vast network of local and international mentors, investors, and corporates.

Exposure to Stakeholders: Startups will have unique opportunities for exposure to key stakeholders, enhancing their visibility and creating valuable connections within the industry.

Regional Business Support: Access to a regional network across the region and support with market expansion.

Commenting on the program’s second cycle, Ramy Koussa, Associate Vice President, Organon, Middle East North Africa & Turkey (MENAT), stated, “Investing in women’s health shows positive return on investment (ROI): for every $1 invested, ~$3 is projected in economic growth. Investing in improving women’s health not only improves women’s quality of life but also enables them to participate more actively in the workforce and make a living. The potential value created through women’s higher economic participation and productivity exceeds the costs of implementation by a ratio of $3 to $1 globally. Launching the second cycle of the Women’s Health Accelerator Program marks a significant milestone in our ongoing commitment to advancing women’s health in the MENAT region. We are excited to deepen our partnership with Flat6Labs and continue listening to the needs of women, identifying innovative solutions that foster a better and healthier every day for her. This cycle is a testament to our sustained dedication to collaboration, innovation, and the empowerment of women-led startups in the digital healthcare space.”

Yehia Houry, Chief Programs Officer at Flat6Labs, emphasized the importance of supporting female entrepreneurs and advancing women’s healthcare, stating, “As we embark on the second cycle of the Women’s Health Accelerator Program, we are thrilled to amplify our support for female entrepreneurs shaping the future of women’s healthcare. This initiative is not just about innovation; it’s about empowering visionary minds to create lasting impact. Our ongoing partnership with Organon and the evolving focus of this cycle reaffirm our commitment to fostering a dynamic ecosystem for women-led startups. Together, we aim to revolutionize the healthcare landscape, ensuring it reflects the diverse and nuanced needs of women across the MENAT region.”

In the accelerator program’s first cycle, we witnessed the remarkable achievements of three standout startups that were announced as the winners: “OMGYNO” founded by Doreen Toutikian and Elisabeth Milini in Greece and Lebanon, “Siira” founded by Sandra Salame in Lebanon, and “Maternally” founded by Yasmin El Mouallem in the UAE. These visionary companies have not only demonstrated innovation and excellence but have also become integral parts of our ecosystem. As we embark on the second cycle, we are thrilled to welcome these winners back into the fold. Their invaluable insights, experiences, and successes will serve as guiding lights for the new cohort of startups, enriching the program with their expertise and contributing to its continued success.

For more information about the Women’s Health Accelerator Program’s second cycle and the application process, please visit our website here. The applications close on May 16, 2024.

What’s the hidden potential in Saudi Arabia? Key Learnings from a decade of early stage investing

In 2013, Flat6Labs made its first regional presence in Saudi Arabia, with the goal of supporting Saudi entrepreneurs to successfully launch their businesses and reach regional and global markets.

Today, as per MAGNiTT’s KSA VC report, Flat6Labs is deemed the most active investor in KSA startups in 2023. In that year, Flat6Labs’ Startup Seed Fund (SSF) reached the highest number of pre-seed and seed transactions in one year in recorded KSA history through the Flat6Labs Riyadh Seed Program, with almost 1,000 startup applications, and 20 startups invested in from a variety of industries including SaaS, FinTech, EdTech, HealthTech, PropTech, Legal Tech, Social Commerce, and Robotics.

This brings us to the question, what are the hidden opportunities in the Saudi market? How could an investor/VC implement a diversified and structured investment process in the region?

————————–

Why do we think Saudi Arabia possesses hidden opportunities?

1- The hidden potential is not correlated with the conventional KSA economy

The International Monetary Fund (IMF) stated that the Saudi economy is undergoing a transformation as reforms are being implemented to reduce dependence on oil, diversify sources of income, and enhance competitiveness. Progress has been most notably reflected in non-oil growth, which has accelerated since 2021, averaging 4.8% in 2022.

Today, FinTech ranked first among industries in the Kingdom as the top industry of choice for investors for deals and capital deployed, contributing to 51% of the country’s capital deployed, followed by e-commerce/retail, enterprise software, EdTech, and healthcare.

The growth of these industries shows global and regional investors that Saudi Arabia has surpassed the tradition related to its conventional economy and is now headed towards a preference for entrepreneurship and tech industries.

2- Early-Stage Startups Are an Underserved Opportunity

While Series C funding saw a notable increase in Saudi Arabia during 2023, pre-seed and seed stages remain more or less flat and appear less observed compared to later stages. This gap in early-stage funding points to an opportunity for institutional investors to be active and take advantage of favorable market dynamics.

3- The Saudi Market Attracts Innovative Entrepreneurs

With a population of over 35 million, Saudi Arabia possesses a large and dynamic consumer market that is exceptionally ideal for tech startups to expand in for the following reasons:

- Saudi Arabia ranks 2nd among countries in internet inclusivity.

- Saudi Arabia has become the biggest user of YouTube per capita in the world, and has the 6th highest active social media penetration in the world, with 99% of the population active on social media.

- Saudi Arabia is proven to have one of the highest and fastest-growing credit card penetration rates in the MENA region.

Besides the attractive consumer market, over 15 million young people will enter the workforce in the region within the next 10 years. Saudi Arabia, with its rapidly growing and youthful population, will represent a large portion of these direly needed jobs, as it attracts immigrants from all around the region.

4- Structural Reforms of The Kingdom

Saudi Vision 2030 builds on the unique position of the Kingdom at the heart of the Arab and Islamic worlds, being an investment powerhouse, and the hub connecting three continents.

One of Saudi Vision 2030’s goals is to raise the share of non-oil exports in non-oil GDP to 50% and increase non-oil government revenue to SAR 1 Trillion.

As per that vision, digital transformation has and will continue to have a momentous positive impact on the Saudi economy, particularly with the diversification of the economy away from its reliance on the oil industry.

In addition, the Saudi government seeks to raise its ranking in the Government Effectiveness Index to 20 worldwide by increasing the effectiveness of its e-government systems, as well as raising its rank in the World Bank’s Ease of Doing Business rank to one of the top 15 economies.

5- Future Prospects

The startup market in Saudi Arabia is growing with a clear government-backed mandate and strategic plans. These plans included boosting the development of the SME sector by the formation of the Council of Economic Affairs and Development, the SME Bank, the announcement of free zones, and notable updates to the companies’ laws. Lately, SMEs in Saudi Arabia have represented almost 93% of total enterprises but account for about 60% of total employment.

Also, as part of the Saudi Vision 2030, Saudi Arabia is aiming to become one of the top 20 countries in ease of doing business.

6- The Untapped Potential for Investors and VCs

Despite the potential in the KSA startup ecosystem, the LP (Limited Partner) base and local funding sources still lag behind international counterparts.

This gap provides opportunities for investors and VCs to tap into the ecosystem early and potentially outperform traditional asset classes. By strategically investing in viable startups, investors can potentially capture significant returns and reap the benefits of early involvement in a thriving ecosystem.

————————–

Lessons learned from a decade of early-stage investing

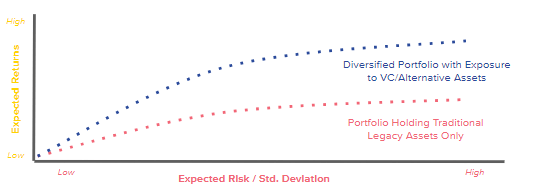

First: Early-stage VC is key to a truly diversified portfolio

Integrating various asset classes is pivotal for constructing a truly diversified portfolio for investors and VCs. Adding relatively small positions in alternative investments provides investors with enhanced returns for the same level of risk. Therefore, funds and other pooled investment vehicles provide an efficient tool to access a large number of investment positions within an asset class.

Throughout our 11-year history, we’ve observed a consistent lack of correlation (and alpha) between the performance of our investment portfolio and the public market equity indices in the MENA region. This highlights the significance of early-stage investments to achieve a truly diversified portfolio.

Second: Open and neutral investment platforms enable market efficiency

Choosing an open and neutral investment platform is integral to nurture a thriving startup ecosystem and enable price discovery and market efficiency. It ultimately benefits all stakeholders, enhancing trust and optimizing resource allocation within the market ecosystem.

Third: There are different fundamental drivers at play compared to other asset classes in the same geography

The KSA startup ecosystem is fueled by unique fundamental drivers that differentiate it from other asset classes in the same geographic region. Government support, a youthful and tech-savvy population, and a strategic Saudi Vision 2030 have created an environment that is ripe for innovation and growth. These drivers have led to the emergence of a distinct investment landscape that offers investors and VCs the chance to tap into untapped potential and capture strong returns.

——————

Flat6Labs’ Fingerprint in Early Stage Startups Funding

After assessing the gap in the market and the risks and opportunities at hand, Flat6Labs became an active investor in the Riyadh ecosystem with strategic positioning and de-risking priorities in mind.

- Strategic Positioning: Flat6Labs’ early-stage focus in Saudi Arabia is a competitive edge, allowing it to fill the market void and lock in attractive valuations for up-and-coming startups.

- Riyadh Seed Program De-Risked Advantage: With a targeted accelerator approach, Flat6Labs’ programs are set to de-risk opportunities by instilling best practices to catalyze growth in the early-stage sector that’s ripe for investment.

What’s next?

The ecosystem in Saudi Arabia possesses untapped potential that deserves to be invested in. From that standpoint, Flat6Labs Riyadh Seed Program supports startups with high growth potential to enhance their entrepreneurial skills and create a space for the Saudi youth to develop their startups and scale up their business in the MENA region.

If you are an early-stage Saudi-based startup, join our Riyadh Seed Program to get cash seed funding, strategic mentorship, networking opportunities, and a multitude of perks and services.