It is not only about fighting gender discrimination.

When investors and VCs are confronted with the need to invest in women in tech, some may express their objectivity in their investment decisions, while others may interpret the call as addressing gender discrimination within the tech investment landscape.

The truth is, investing in women in tech is not only a call for inclusion. It is also an opportunity for investors and VCs that can lead to stronger portfolios.

Flat6Labs recognizes this opportunity and is committed to advancing gender inclusion through its investments. With nearly 80% of funding deals in 2023 directed to women-led tech startups, Flat6Labs shares reasons why VCs should back more women in tech.

Reasons Why Investors and VCs Should Invest in Women in Tech

1. Women-led startups generate more ROI

A study by BCG and MassChallenge found that women-led companies yield better returns on investment (ROI), generating 35% higher ROI than men-led companies. This is just one study out of dozens of other studies that reached the same conclusion; women founders outperformed their male peers.

2. Women-led companies are underfunded

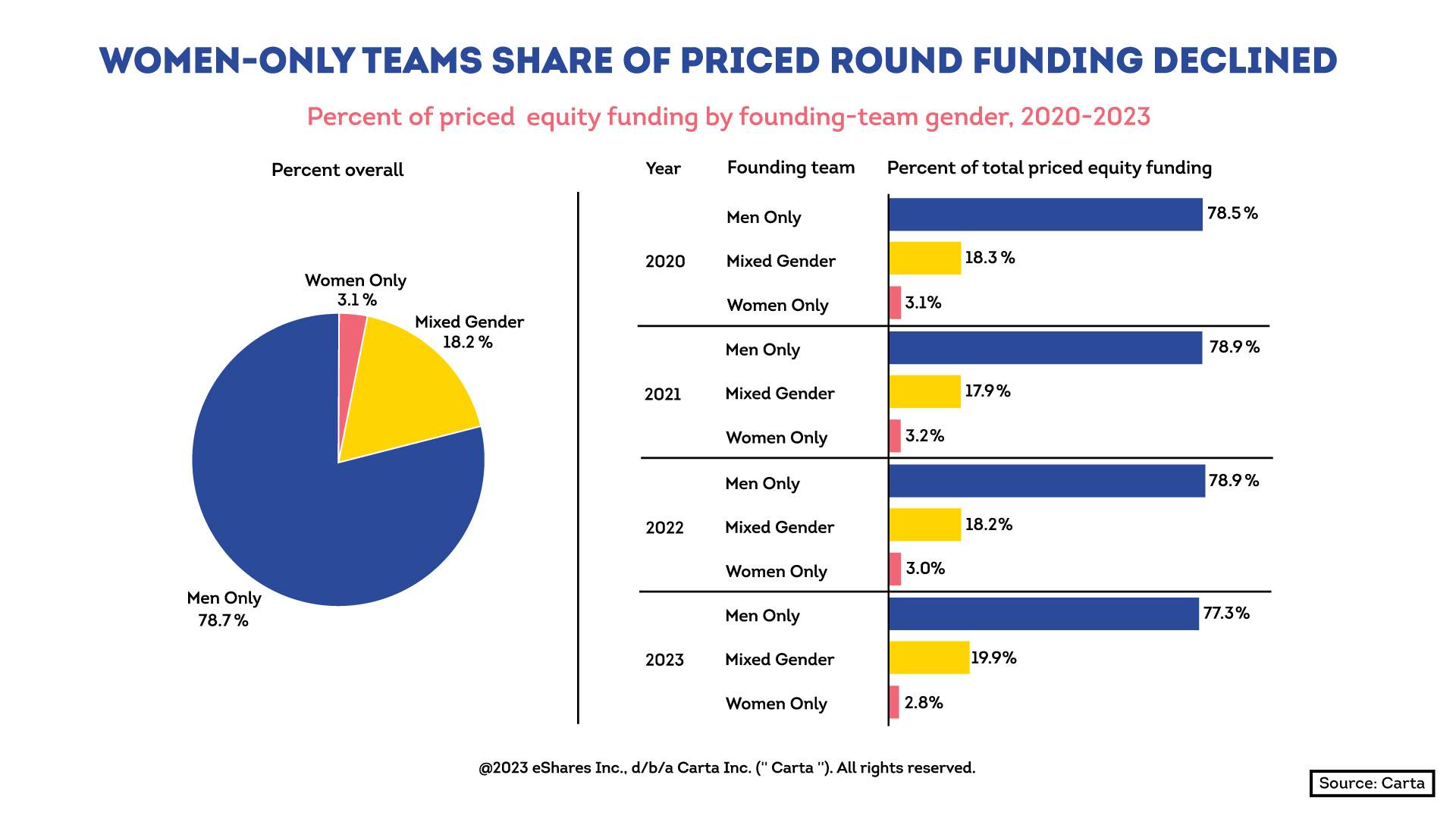

Despite the evidence that women-led startups outperform, women-led startups raised only 2.8% of all venture capital funding, according to Carta’s annual equity report of 2023.

Meanwhile, according to Startup Genome, 15% of tech startup founders are women, while about a third have at least one woman founder worldwide.

The gap is clearly shown as women represent a meaningful share of founders while having their startups underfunded nevertheless, presenting an opportunity for investors to take the lead and reduce the gap.

3. The stereotype against women in tech was based on a faulty study

In 1966, System Development Corporation (SDC), a computer software company based in Santa Monica, California, hired two psychologists, William M. Cannon and Dallas K. Perry, to develop a personality profile for programmers. The goal was to assist SDC’s recruiting process and enable the company to predict the best candidates.

According to Emma Jones, CEO of Project F, Cannon and Perry interviewed a predominantly male sample of engineers to develop this profile. Of the 1,400 engineers they interviewed, 1,200 (86%) were men. As a result, the profile they developed disproportionately identified men as ideal candidates for programming jobs and penalized extroverts and people who have empathy for others, traits that women were more likely to carry compared to men.

This faulty study has had a heavy influence on the industry, impacting how companies have viewed ‘ideal’ programmers and their recruitment practices for decades. Even today, we hear statements such as “women are not good with computers” or “STEM is for geeks”, which are misguided and reinforce biases that limit diversity and inclusion in the field.

4. Women founders are more likely to generate jobs for women

As Maya Oda Pacha, Investment Associate at Flat6Labs, mentioned, “Women founders tend to have more women employees hired at their startups, which contributes to reducing the gender inequality in employment.”

Flat6Labs investment data supports this observation. When we analyzed new jobs created by our portfolio companies between 2011 and 2023, we found that, among women-founded companies, 54% of new jobs went to women. This compares to 32% of new jobs going to women among the remainder of the portfolio.

5. Bias can prevent us from backing investable women-led companies

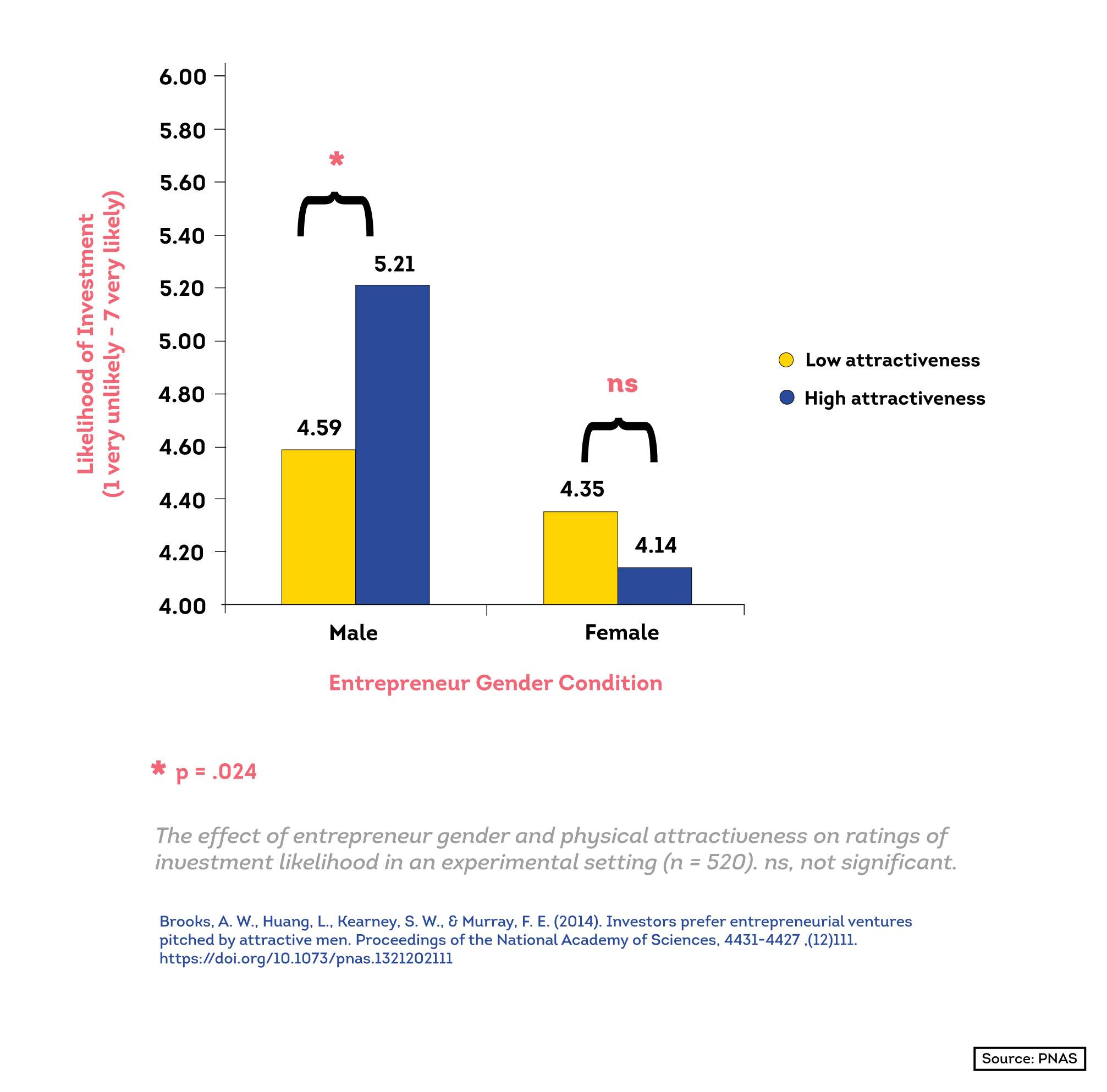

In an experimental study by Alison Brooks and others that tests whether investors made decisions based on gender and attractiveness, investors were shown pitches with typical content and were asked to rate the probability of success for the pitches. Findings show that investors were more likely to to invest in attractive men (average score 5.21), followed by unattractive men (4.59), then unattractive women (4.35), and lastly attractive women (4.14).

To the extent that women entrepreneurs are disadvantaged in entrepreneurial pitching simply by virtue of their gender, then women may remain underrepresented in the entrepreneurial economy, despite their entrepreneurial abilities, because of internal bias.

As mentioned by Kristen Lee in Psychology Today, there is no such thing as an unbiased person. Although all humans have some sort of bias, investors and VCs ought to fight bias and prejudice as much as possible in order to reach wise decisions, because, despite the investors’ preferences for males in the experiment, women founders were factually the ones most likely to succeed in the previously-mentioned study by Alison Brooks and others.

6. Women entrepreneurs are likely to understand their customers

Even in tech industries that target women solely, women founders still receive less funding. In the Femtech industry that focuses on finding solutions for women’s health, male-founded startups raise much more capital than their female peers, with an average of $9.2m, compared to only $4.6m by women-founded Femtechs between 2018 and 2022.

So, with 70% of the Femtech startups founded by women and this significant lack of investment for them, there is more demand for investment than there is supply. This resembles the vast opportunity for investors to tap into an underserved market, yielding substantial returns and driving positive societal impact.

7. Those who are not enabled will never have the chance

A report shared in 2023 provided some shocking statistics, key findings included:

- 56% of women in tech are leaving their employers mid-career.

- Women leave the tech industry at a 45% higher rate than men.

- Only 24% of computing jobs are held by women.

With these numbers, one might consider that women are naturally not interested in/not suited for the tech industry. However, the same research showed that:

- In the tech industry, men are offered higher salaries than women for the same position 60% of the time.

- In 2016, women-led tech companies received $1.46 billion in investments from venture capitalists, while male-led companies received $58.2 billion.

- Computer code written by women was accepted 78.6% of the time on GitHub – 4% more than code written by men – when the coder’s gender was kept secret. However, when contributors are identifiable as male or female, men’s code is accepted at a higher rate.

Therefore, the reason why women are underrepresented in the tech industry is not due to their lack of experience but rather due to having fewer opportunities and not being equally enabled.

Opportunities For Women in Tech in The MENA Region

When asked about the opportunities for women in tech, Doaa Aref, Founder and CEO of our Egypt portfolio company Chefaa, explained, “Theoretically, opportunities in tech for women should be the same as for men.” She added, however, that women usually seek opportunities where gender-based rejection is less likely, “..This is an assumption they (women) may have due to societal pressure. This should be the core problem to solve.”

Consequently, moving towards minimizing the gender gap for founders in the MENA region, some programs are fully dedicated to supporting women-led startups, such as:

- Women’s Health Accelerator: The Women’s Health Accelerator Program, launched by Flat6Labs and Organon, aims to support mostly women-led startups that focus on enhancing women’s health and wellness across the MENAT region.

- She WINS: Flat6Labs partner, IFC, launched She WINS Arabia, a program that aims to help women-led startups across the Middle East and North Africa (MENA) get the advice, mentorship, and finance they need to grow.

Read more about global opportunities for women in tech on TechGuide.

Final Call to Invest in Women in Tech

Flat6Labs’ decade of experience shows how pivotal it is to invest in gender equality by investing in women founders and employees as well; having 51% of women employees and 50% of women at the leadership level at Fla6Labs has contributed to the company’s overall success.

“From that standpoint,” added Maya, “The world needs more women partners at the fund levels who could support female entrepreneurs and consequently support women employment because people tend to invest in people they identify with.”

Investing in women in tech is not just a matter of diversity and inclusion; it’s a strategic decision with benefits that investors and VCs shouldn’t overlook.

As evidenced by numerous studies and real-world examples, women-led startups outperform their male counterparts in terms of ROI and commitment to gender equality. However, despite these compelling reasons, women founders continue to face systemic biases and unequal opportunities.

We need to enable both men and women to reach their full entrepreneurial potential. Founders are not born, they are created, and general stereotypes and biases against women in tech have hindered the creation of talented leaders.

For more information regarding current opportunities for women in tech in Flat6Labs, visit: https://www.flat6labs.com/programs/