Flat6Labs Hosts Sixth Demo Day of Riyadh Seed Program

Backed by F6 Ventures, the program accelerated 60+ startups, deployed USD 17M, and unlocked USD 38M in follow-on funding and co-investments

Riyadh, Saudi Arabia – January 14, 2026 – Flat6Labs hosts today the Sixth Demo Day of its Riyadh Seed Program (RSP) in Riyadh, , the most active VC in the kingdom for the past 3 years, in partnership the Saudi Venture Capital Company (SVC), with key national ecosystem stakeholders, including Jada Fund of Funds, and Riyadh Valley Company (RVC). The event marks the conclusion of six accelerator cycles supported by the National Technology Development Program (NTDP) since the program’s launch in 2023 and represents a major milestone in fostering early-stage entrepreneurship in Saudi Arabia.

To date, the RSP, supported by the National Technology Development Program (NTDP), has accelerated more than 60 startups and deployed about USD 17 million in seed investments by F6 Ventures’ Startup Seed Fund LP, which received backing from anchor LP SVC, and key LPs, Jada and RVC, and enabled USD 38 million in follow-on funding and co-investments. Collectively, the program has supported over 130 founders and contributed to the creation of more than 440 jobs in Saudi Arabia, underscoring its long-term economic impact.

In addition to seed funding, the program offers a localized market-driven acceleration model that emphasizes hands-on strategic mentoring, business training, networking opportunities, and increased visibility for investors. It aims to equip founders with the operational capabilities and insight required to build scalable, investment-ready companies.

The RSP also receives support from the National Technology Development Program’s Empowering Accelerators product, reflecting strong alignment with national objectives to advance innovation and technology-led growth.

During the upcoming Demo Day, selected companies from the sixth cohort will present their progress to an audience of investors, partners, and media. In addition, F6 Ventures will highlight the broader portfolio of investments completed over the past year, providing a comprehensive view of the fund’s activity and impact.

The sixth cohort reflects the breadth and depth of innovation emerging from the Saudi market, with startups operating across artificial intelligence and data infrastructure, fintech, health tech, enterprise software, industrial AIoT, mobility, and retail analytics. The cohort includes ventures such as CoreTechX, AI‑driven system that builds searchable databases and enables private GPT‑like queries over handwritten Arabic archives; Digital Petroleum, AIoT sensors and software for oil & gas, utilities and manufacturing; Bookahospi, AI infrastructure that automates the international mobility of healthcare workers; Sanadk, AI‑powered accounting platform that integrates bookkeeping, tax filings and financial management in one interface; Nero, autonomous delivery vehicle that reduces last‑mile delivery costs which was selected for the Transport Authority’s future mobility sandbox; MEDirect, health‑tech SaaS platform that enables physicians and medical complexes to launch virtual clinics with integrated payments, labs, pharmacies and radiology; and Rintel, AI‑powered data platform connecting FMCG suppliers and retailers, providing real‑time insights on sales, inventory and forecasting.

The final Demo Day underscores the importance of institutional collaboration in building a resilient and globally competitive venture capital ecosystem. Through the collective efforts of its ecosystem partners, the Riyadh Seed Program has contributed to expanding the pipeline of high-potential Saudi startups and strengthening their readiness for growth.

As these companies progress into more advanced stages, continued coordination across capital provision, capability-building, and ecosystem connectivity will remain essential. Through Flat6Labs’ programs and F6 Ventures’ early-stage investment activity, the group continues to support high-potential founders and reinforce Saudi Arabia’s position as a leading regional hub for innovation, venture investment, and private sector growth in line with the Kingdom’s economic diversification objectives.

About Flat6Labs

Flat6Labs is the leading entrepreneurship platform in emerging markets, supporting founders to build, launch, and scale technology-driven companies through acceleration programs, ecosystem development, and tailored innovation services. Since its launch in 2011 in Cairo, Flat6Labs has supported more than 8,000 entrepreneurs across Africa, the Levant, and the GCC, working closely with governments, corporates, and global partners to strengthen local innovation ecosystems. With a strong commitment to inclusivity, Flat6Labs has a proven track record of supporting women and forcibly displaced entrepreneurs, whose ventures have collectively generated more than 90,000 jobs and contributed to sustainable economic growth across the region. Flat6Labs is part of the F6 Group, alongside F6 Ventures.

About F6 Ventures:

F6 Ventures is a seed-stage venture capital firm providing capital, hands-on support, and access to a strong regional and international network to help early-stage founders from the Middle East and Africa scale their businesses beyond borders.

Flat6Labs Celebrates Achievements of 3-Year StartMashreq Program Across Jordan, Lebanon, and Iraq

(Amman, Jordan – Day December 2025) – Flat6Labs, the Middle East and Africa’s leading entrepreneurial ecosystem builder, celebrated the conclusion of its StartMashreq Program at the “StartMashreq Forum.” The event, held in Amman on 11 December, marked the culmination of the program supporting innovation and startup growth in Jordan, Lebanon, and Iraq.

StartMashreq—led by Flat6Labs in partnership with the Kingdom of the Netherlands and supported by the International Finance Corporation (IFC)—launched as a platform for creating economic opportunities and driving growth across the Levant, with particular focus on women and forcibly displaced persons (FDP). It played a pivotal role in strengthening the entrepreneurial landscape across the Levant, proving that even in frontier markets and fragile communities, founders can attract funding and scale when given the right support.

The event brought together entrepreneurs, investors, industry leaders, policymakers, and regional partners to highlight the program’s achievements. Distinguished guests included H.E. Stella Kloth, Ambassador of the Kingdom of the Netherlands to Jordan, and AbdelKader Al Batayneh, Executive Director Strategies, Ministry of Digital Economy and Entrepreneurship of Jordan, whose attendance reflected the depth of collaboration behind this success.

Over its three-year duration, the program supported over 4,500 entrepreneurs, reached more than 3,000 women and FDP entrepreneurs, created 350 direct jobs, and supported startups in securing over USD 28 million in funding with USD 51 million in revenues generated. These outcomes demonstrate measurable impact on economic growth, job creation, gender inclusion, and startup scalability, highlighting its positive impact on emerging innovation markets.

Commenting on the program’s impact, Hany El-Sonbaty, Chairman and Co-Founder of Flat6Labs, said, “StartMashreq marks a meaningful shift in how entrepreneurship is supported across the region. The past three years prove that when founders gain knowledge, access, and exposure, they build companies that create jobs, attract capital, and accelerate economic growth. We are incredibly proud of these achievements and determined to scale this impact beyond the region.”

On the enormous potential in the region, IFC Regional Director for the Middle East, Pakistan, and Afghanistan Khawaja Aftab Ahmed noted: “Entrepreneurship once again proves to be a powerful pathway to resilience and inclusive growth. By empowering startups, we aimed to unlock the potential of a young, educated population and help them address some of the region’s most pressing challenges. StartMashreq has enabled the creation of hundreds of jobs, expanded opportunities for vulnerable communities, and supported graduating startups in mobilizing their own capital to scale across the region, fully in line with IFC’s priority to promote private-sector–led growth.”

H.E. Ambassador Stella Kloth affirmed the Netherlands’ commitment to supporting regional innovation, stating, “We are proud to have supported StartMashreq – a program that helped unlock the potential of thousands of young entrepreneurs, including women and refugees, whose ideas will shape the region’s future. The progress celebrated today is only the beginning, and the Netherlands remains committed to supporting entrepreneurial growth and innovation in Jordan and the MENA region.”

With the program now complete, Flat6Labs is preparing to enter a new phase of expansion, extending the StartMashreq model into additional regions where entrepreneurial potential continues to rise. The program’s success across the region positions it as a strong and replicable model for entrepreneurship in challenging environments, demonstrating that targeted ecosystem interventions can overcome early-stage barriers, scale across borders, access global markets, and unlock new capital pathways.

Flat6Labs Appoints Khaled Abu Alkheir as Program Director to Lead Pre-Accelerator Launch in Palestine

Flat6Labs, the leading entrepreneurship platform in emerging markets, has appointed Khaled Abu Alkheir as Program Director. With over 15 years of experience in technology, investment, and entrepreneurship.

Khaled has held leadership roles at Palnet, Jawwal, PDF Solutions, and gSoft, founded CoDoo Innovative Solutions, co-founded PinchPoint—Palestine’s first VC-backed gaming studio—and later served in senior positions at Freightos and SocialDice.

He also led early-stage financing programs under the World Bank-funded IPSD project and most recently directed the USAID-funded Hassaleh Innovation Fund, supporting high-potential entrepreneurs in conflict-affected areas of Palestine.

Now, as Program Director at Flat6Labs, Khaled is set to leverage his extensive experience to lead this new initiative in Palestine. “This is a defining moment for Palestinian entrepreneurship. By connecting local founders with the resources, expertise, and networks that Flat6Labs brings to the table, we can unlock new opportunities for growth and innovation that will resonate far beyond Palestine,” shares Khaled Abu Alkheir.

The pre-accelerator program is set to launch August 17th, 2025, marking a major step in Flat6Labs’ commitment to empowering Palestinian entrepreneurs, fostering innovation, and building a sustainable startup ecosystem that will connect local founders to regional and global opportunities.

Flat6Labs in Africa: 2024 Roadshow Highlights

The Structure That Made It Work

- 7 countries

- 380+ startup applications

- 70+ mentorship sessions

- 40+ expert coaches and mentors

- 7 local partners

- All in one year

Country-by-Country Impact

Rwanda: Setting the Foundation

Kenya: Tech-Focused Excellence

Nigeria: Virtual Innovation

Tanzania: Women-Led Growth

Senegal: Francophone Expansion

Morocco: North African Gateway

Uganda: Closing Strong

Looking Ahead

Flat6Labs Grows Bigger: Introducing F6 Group

Cairo, Egypt – August 2025

Flat6Labs celebrates a pivotal milestone: the launch of F6 Group, a newly formed entity integrating venture capital and entrepreneurial support, anchored by two powerful arms: F6 Ventures, a newly launched seed-stage investment firm, and Flat6Labs, the region’s most recognized startup accelerator platform.

To catalyze this transformation, F6 Group launches F6 Ventures, a dedicated and independent venture capital firm, managing seed funds across the Middle East and Africa. Led by Co-Founders and General Partners Dina el-Shenoufy and Ramez El-Serafy, focusing on generating strong financial returns through selective early-stage tech investments.

Flat6Labs continues as the region’s leading entrepreneurial ecosystem architect, designing and delivering programs that empower founders, drive innovation, and create real economic impact, under the leadership of CEO Yehia Houry.

F6 Group brings together venture capital and founder support under one platform, purpose-built to serve startups across emerging markets. By aligning investment and programmatic expertise, F6 Group delivers unmatched access to capital, programs, and expertise, turning visionary founders into market leaders.

We’re deeply grateful for your continued support and look forward to building this exciting new chapter together.

Learn more at: www.f6.group and www.f6.vc

Egypt’s ICT Minister Attends Launch of ‘InvestIT’ Program in Partnership with ITIDA, Flat6Labs

Cairo, Egypt – November 4th, 2024 — The Minister of Communications and Information Technology in Egypt, Dr. Amr Talaat, has attended the launch of “InvestIT,” a program aimed at supporting tech startups. The program is a joint effort by the Technology Innovation and Entrepreneurship Center (TIEC) of the Information Technology Industry Development Agency (ITIDA) and Flat6Labs, the prominent seed and early-stage venture capital firm in the MEA region.

InvestIT is an innovative investment-readiness support program that supports ICT-enabled startups at the seed or pre-series A stages from various governorates across Egypt. The program is designed to empower startups to finalize investment deals successfully. By fostering a supportive ecosystem, InvestIT helps startups navigate the complex landscape of investment and growth.

The program is implemented in two phases. First is the Preparation Phase, which involves qualifying startups through training, one-on-one coaching, essential tools, and resources. The second is Investor Engagement, where startups are connected with potential investors.

In his remarks, the ICT Minister highlighted the government’s commitment to fostering a supportive environment for tech startups and entrepreneurs. He outlined several initiatives aimed at skill development for entrepreneurs, attracting global incubators and accelerators, connecting startups with investors, and establishing Creativa Innovation Hubs across the country. Such efforts are aimed at helping entrepreneurs transform innovative ideas into successful businesses.

Talaat also emphasized efforts to facilitate startup registration and simplify post-establishment processes, along with significant investments in digital infrastructure. Additionally, he noted that Egypt ranks among the top three countries in the Middle East and Africa in terms of venture capital attraction.

ITIDA CEO Ahmed Elzaher expressed his enthusiasm for collaborating with Flat6Labs as part of the Agency’s commitment to enhancing and accelerating the growth of Egyptian startups. He emphasized the importance of creating a supportive ecosystem that boosts startups’ global competitiveness. Elzaher noted that the InvestIT program is part of ITIDA strategy to assist entrepreneurs at every stage, from initial idea development to growth and expansion into international markets.

For his part, Founder and Chairman of Flat6Labs Hany Al Sonbaty emphasized his company’s ongoing support for innovative Egyptian entrepreneurs, a commitment that dates back to 2011. He explained that InvestIT is designed not only to prepare startups for investment but also to equip them with essential tools and a network of connections to help them expand their businesses. Al Sonbaty reaffirmed Flat6Labs’ dedication to fostering a vibrant business environment through collaboration with ITIDA and TIEC, aiming to empower startups and enable them to create a meaningful impact in the Egyptian IT landscape.

The program implementation contracts were signed by Elzaher and Al Sonbaty, with the presence of Flat6Labs Founder Ahmed El Alfi, CIO Dina El Shenoufy, and officials from MCIT and TIEC.

InvestIT will support 12 startups through a six to eight-week program that helps startups develop investment-related strategies and pitch their businesses to investors. Upon completion of the program, the startups will have the opportunity to connect with potential investors, with continuous support and guidance from the program team.

The program is open to ICT-enabled startups at the seed or pre-series A stages, with a launched product or service. Startups must be operational in Egypt for at least two years before the program’s starting date, with the founding team consisting of two or more members.

For applications, kindly click here.

Entrepreneurs Triumph at Organon and Flat6Lab’s Women’s Health Accelerator Demo Day

- The Demo Day, held in collaboration with Flat6Labs, marked the closing of the second edition of the Women’s Health Accelerator Program

- Eight start-ups from the UAE, Lebanon, Egypt, Tunisia, and Poland presented their women’s health solutions to a panel of industry experts

Dubai, United Arab Emirates – 15 October 2024: Eight pioneering start-ups who participated in the second edition of the Women’s Health Accelerator Program, attended Organon’s Demo Day during the ‘Expand North Star’ event at Dubai Harbour, hosted by GITEX Global. This initiative, a collaboration between Organon, a leading global healthcare company dedicated to improving women’s health, and Flat6Labs, MENA’s premier seed and early-stage venture capital firm, aims to address unmet women’s healthcare needs across the region. This year’s edition was launched on March 8, in celebration of International Women’s Day.

The Demo Day saw shortlisted startups from the UAE, Lebanon, Egypt, Poland and Tunisia pitch solutions that exemplify the remarkable innovation and potential impact on women’s health that the accelerator program aims to foster. Over the course of the program, these start-ups have benefitted from an array of resources provided by the program, including strategic mentorship, entrepreneurship-focused business training, subject matter one-to-one sessions, and a multitude of services from partners.

In the session, the shortlisted start-ups pitched their innovations to an esteemed judging panel comprising Dina el-Shenoufy, Chief Investment Officer at Flat6Labs; Ramy Koussa, Associate Vice President of META at Organon; Dr. Asma Al Mannaei, Executive Director of the Research and Innovation Centre at the Department of Health – Abu Dhabi; and Lyndal Cordaro, Head of Nursing at King’s College Hospital London – UAE.

iYoni, an innovative mobile app offering precise AI-based fertility predictions, automated lab test assessments, and advice from fertility experts, took first-place and received a prize of 15,000 USD. In her pitch, Katarzyna Goch, CEO of iYoni, outlined her ambitious plans to expand to the UAE market.

Taking the second-place prize of 10,000 USD was Noor Jaber, CEO of Nawat from Lebanon, a digital platform offering holistic reproductive health education and breaking the taboo around women’s health issues in the region. In third place and receiving a 5,000 USD prize was Banet from Tunisia, an app that empowers women with reliable health information and provides women with direct access to healthcare professionals for their health and wellness needs.

Among the other innovative projects presented at the event was Yotto from the UAE, a platform optimizing female athletes’ performance through hormonal monitoring, addressing a significant gap in sports science. Another UAE-based startup, Mamahood, introduced a comprehensive support system for women during fertility, pregnancy, and motherhood, offering a 24/7 live chat with doctors and a supportive community. Me-Now, also from the UAE, aims to guide women through perimenopause and menopause, ensuring they receive the necessary support and understanding during these transitions.

In addition, several other startups showcased their groundbreaking solutions, addressing critical subjects in women’s health in the region. InBalance, an initiative from Lebanon, outlined their app that offers personalized AI-powered treatments for PCOS patients, aiming to naturally improve health outcomes. The Aziza App from Egypt, tailored specifically for Egyptian women, was also presented, providing meaningful menstrual health tracking and management.

Speaking at the opening session of the Demo Day, Ramy Koussa, Associate Vice President of META at Organon, said, “The Women’s Health Accelerator Program has been a remarkable journey of innovation and collaboration. We are incredibly proud of the startups that participated and the groundbreaking solutions they have developed. Inspired by the success of this program, we were thrilled to launch the second edition, aiming to enhance our support by empowering women economically and fostering new ideas that enhance women’s health. At Organon, we believe that addressing women’s health needs is essential for building resilient and thriving communities. This program is a testament to our commitment to fostering innovation that directly impacts women’s lives.”

Dina el-Shenoufy, Chief Investment Officer at Flat6Labs, said, “Supporting founders in the Femtech industry is critical to advancing -not only women’s healthcare- but also driving broader economic growth. Through programs like Women’s Health Accelerator, we ensure that female founders receive the tools and resources they need to succeed and make a meaningful impact on women’s lives. We are proud of all the startups who participated in this program; they showed us how the next generation of female leaders are focused on addressing the unmet needs in women’s health.”

Katarzyna Goch, CEO of the winning start-up iYoni, commented, “Participating in the women’s health accelerator program was an outstanding experience. From the very beginning, we connected with experts who provided invaluable advice that I can implement both now and in the future.”

The accelerator program, initiated shortly after Organon’s expansion into the region, represents a pioneering ESG initiative that underscores Organon’s dedication to addressing women’s health needs. This program, aligned with Organon’s mission to enhance the lives of women and girls through improved health outcomes, was meticulously crafted to bolster female entrepreneurship and support digital health startups.

Shell Egypt Relaunches Intilaaqah Programme in Collaboration with Flat6Labs

Shell Intilaaqah Egypt Programme will support & influence more than 1000 young entrepreneurs per year through matchmaking, boot camps & incubation.

Cairo, Egypt – 22 July 2024 – Shell Egypt is excited to announce the relaunch of the Shell Intilaaqah Egypt Programme, in collaboration with Flat6Labs. This initiative is part of flagship enterprise development global programme Shell LiveWIRE, and aims to empower and support over 1,000 aspiring entrepreneurs in Egypt. The programme is dedicated to fostering innovative solutions to address global challenges through fostering entrepreneurship.

For nearly two decades, the Shell Intilaaqah Egypt Programme has been a beacon of innovation and growth, nurturing over 10,000 youth across the nation and contributing to the establishment and scaling of approximately 200 startups. The programme has not only spread awareness about entrepreneurship, but have also supported many individuals in starting new businesses and expanding existing ones.

Dalia Elgabry, Vice President and Country Chair, Shell Egypt commented: “As a responsible investor, Shell Egypt has a long-standing history of supporting our local communities through impactful Social Investment (SI) programmes.

These initiatives are designed to create sustainable benefits for our stakeholders, addressing some of the most pressing challenges we face today. We are proud to support the community through pioneering capacity-building programmes like Shell Intilaaqah. Together in collaboration with Flat6Labs, we are committed to creating significant opportunities for early-stage entrepreneurs, providing them with the necessary support to overcome challenges and succeed in their entrepreneurial journey.”

Shell LiveWIRE, operates in 20 countries to strengthen local economies through entrepreneurship, innovation, and meaningful employment. The Shell Intilaaqah Egypt Programme will leverage this global experience to support and train more than 1,000 entrepreneurs per year through a series of matchmaking, ideation, bootcamps & incubators. The most promising 240 teams or ideas from these sessions will be selected to participate in the Bright Ideas Bootcamp Training. From these, the top-performing 40 teams will be invited to join the 3-month Intilaaqah Incubation cycle, across two cycles per year.

Hany Al-Sonbaty, Co-founder and Chairmanof Flat6Labs added: “Flat6Labs is thrilled to collaborate with Shell Egypt and become their social investment delivery and innovation partner in the country. This collaboration in relaunching the Shell Intilaaqah Egypt Programme will create significant opportunities for early-stage entrepreneurs, providing them with the necessary resources and mentorship to turn their innovative ideas into successful ventures.”

The programme will inspire the Egyptian youth through hybrid ideation and matchmaking sessions, training them on how to ignite their startup journey via eight bootcamp cohorts, select the teams to participate in the 3-month Intilaaqah Incubation Cycle, and spotlight three winning projects during Intilaaqah Annual Award Ceremony.

Flat6Labs will implement the Shell Intilaaqah Egypt Programme and help tailor it to support entrepreneurs in defining their mission, vision, and initial strategy, helping them build a pipeline and raise awareness about entrepreneurial opportunities. Selected participants will attend workshops delivered by subject matter experts, providing them with access to globally tested and successful startup practices. The programme will focus on empowering the next generation of young people to become innovative entrepreneurs, equipping them with the skills to identify market needs and develop solutions to specific challenges facing the Egyptian economy.

Shell Egypt’s social investment programmes contribute to the delivery of Egypt’s 2030 Strategy Goals and UN Sustainable Development Goals. Shell Egypt delivers a portfolio of programmes in collaboration with partners such as Ministry of Petroleum, Egyptian universities, The National Training Academy, and the World Food Program

How to Integrate AI Within your Startup: The Role of AI in Startup Growth

In the ever-evolving landscape of entrepreneurship, one question resonates loudly: Where does Artificial Intelligence (AI) belong within the heartbeat of a startup? Integrating AI within a startup’s framework holds immense potential for founders, offering opportunities to automate tasks, gain valuable insights through data analysis, and enhance engagement with customers and employees.

With labor shortages, high costs, and a fast-paced ecosystem, startups are encouraged to integrate AI to remain competitive and agile in today’s dynamic business environment.

Where could founders apply AI technologies within their startups?

Broadly speaking, AI can support three important business needs: automating business processes, generating new creations, and gaining insight through data analysis.

Automation of tasks

Every role has at least a few repetitive and manual tasks, such as checking emails, inputting data, and generating reports, that take away time from more impactful work. A McKinsey survey found that automation reduced costs by 10-15% and cut order processing time from 2-3 days to 1-2 hours.

In addition to that, a survey of 7,700 sales professionals from Salesforce found that sales representatives spend an average of less than 30% of their week on actual selling. Rather, much of their time is spent on manual tasks such as data entry and sharing updates on their deals in the pipeline. AI tools can help automate time-consuming tasks so sales representatives, as well as other employees, can free up time for more productive work while reducing the risk of human error.

“Our near-future plans in Flat6Labs include automating 80% of the filtration process for applications to our programs as our programs’ team receives thousands of applications,” says Shady Atef, Product & Tech Director at Flat6Labs. “It would be more efficient to focus most of their efforts on reviewing applications of higher quality and interviewing more serious applicants, rather than the process itself so that promising startups get the opportunity they deserve. This, however, still requires human supervision and upper hand in all cases, yet it would save a lot of time and effort for both our team and the startups who applied.”

Generating Content

At the heart of Generative AI lie massive databases of texts, images, code, and other data types. This data is fed into generational models that could use this data to create images, videos, 3D models, music, or text.

There are 2 types of Generative AI tools that benefit startups’ growth:

- Ready-to-launch tools:

Platforms like ChatGPT, Synthesia.io, and Google Gemini come pre-trained on vast datasets, allowing users to tap into their generative capabilities without building and training models from scratch. Startups can fine-tune these models with specific data, nudging them towards outputs tailored to particular business needs. However, these public options offer limited control, less customization of model behavior and outputs, and the potential for bias inherited from the pre-trained models.

- Custom-trained models:

Most organizations can’t produce or support AI without a strong partnership. Innovators who want custom AI can pick a “foundation model” like OpenAI’s GPT-3 or BERT and feed it their data. This personalized training sculpts the model into bespoke generative AI perfectly aligned with their business goals.

One of our portfolio companies in Egypt, Katteb, provides generative AI services in multiple languages where SMEs and copywriters can get instant articles and social media content that is fact-checked and ready to go live.

Analysis and Insights and Predictions

Ibrahim Ashqar, founder of Lumi AI, our portfolio company in UAE, mentions how AI tools provide insights and predictions to decision-makers in a way that has never been available before.

“Lumi AI democratizes the access to insights to people who aren’t technical,” says Ibrahim. “When an employee in any department doesn’t know how to code or manipulate data, they could use Lumi AI to ask the question in plain language and get insightful answers to help them in product designing, marketing, or any other field.”

This has been shown clearly with one of Lumi AI’s clients, a huge textile manufacturer who produces jeans and denim, and used to buy a lot of raw materials from a lot of different suppliers. When Lumi AI was connected to their database, within seconds the executive team found out that there are suppliers who are charging more for the same raw material compared to other suppliers. They were able to save around $600,000 based on these rapid and precise analytics.

Similarly, founders find MilkStraw extremely helpful. MilkStraw AI, our portfolio company in UAE, uses an AI model that integrates with a company’s infrastructure and comes up with recommendations to save them up to 75% on Cloud bills.

In addition, Digital First AI, our portfolio company in UAE, uses AI models to recommend the best marketing tactics for companies and SMEs based on their answers to a few questions about their business. It also provides access to a library of tactics where founders are able to view the strategies of popular brands and experienced marketers that the AI models were trained on.

How to find AI-skilled talents for your startup

As a startup founder, integrating AI into the company’s daily operations means hiring the right talent in each role. The right talent will use AI tools in their department to have the work done rapidly and efficiently. So, how could you know that your hire would utilize AI to the startup’s benefit?

“The most needed skills to look for in any hire are adaptability and resilience,” says Nour Mohieddine, our Talent Acquisition Manager at Flat6Labs. “In 2024, founders shouldn’t necessarily find employees with experience in utilizing AI tools, but rather look for ones who are willing to learn new ways to work and are flexible with new technologies. This way you guarantee that even the new technologies that are yet to emerge in the future will be embraced with open minds.”

Founders should use behavioral assessments to assess skills related to learning AI. These skills include:

- Resilience and adaptability

- Seeking lifelong learning

- Having a growth mindset, not a fixed one.

- The ability to thrive in a fast-paced environment

- Problem-solving

- Having a positive attitude ( to embrace the change)

Providing AI training within your startup

A recent study by the World Economic Forum shows that the cost of hiring a new worker can be as much as seven times that of upskilling an existing employee.

Founders who invest in AI training for themselves and their employees will have the opportunity to pioneer in their industry. An international survey by Boston Consulting Group found that while 86% of workers believed they would need training in AI, only 14% of front-line employees reported receiving any upskilling training. This gap presents an opportunity for startups looking to upscale.

If you are looking for intensive training, check the courses provided by eFlow, our portfolio company in Jordan. eFlow is a great learning platform for employees for different reasons:

- eFlow courses include Artificial Intelligence, Web 3.0, NFTs, digital literacy, and more.

- eFlow is an AI-powered platform, therefore, its expertise in AI is hands-on.

- eFlow offers 10-15 minute micro-courses in English, Arabic, French, and Spanish.

- Employees and learners could reach the educational content through Whatsapp, Telegram, Microsoft Teams, or Slack.

While going through the learning and development process for AI in your startup, consider the following topic to tackle:

- Integrating AI into existing processes

- Troubleshooting common AI issues/bugs

- Understanding of the concept of machine learning

- Familiarity and confidence with AI tools

- Crafting an effective ChatGPT prompt

- How to find guidance on AI

- Ethical considerations relating to AI

- The link between data, algorithms, and modeling

- Critical analysis of AI-generated responses

- Understanding the limitations of AI

- Selecting the right AI tool

Is your startup developing AI solutions?

AI is not a replacement for human talent. It only takes away the mundane tasks so humans could focus more on their growth.

As Shady Atef, our Product & Tech Director, mentioned; “Before the invention of washing machines, humans used to carry out laborious tasks just to get their clothes washed. The challenge of not having clean clothes was the main focus. Now that we have washing machines, humans could focus, not on the cleanliness of clothes, but on making them smell like roses and having them instantly steamed and ironed.”

If the founders and employees of a startup have more time to focus on new ways for the startup’s growth rather than on keeping it functional with the automatic and less creative tasks, one could only imagine which skies they would reach.

If your startup is developing tech solutions to modern challenges, check the open applications to Flat6Labs Programs in the MENA region, aiming to accelerate the growth and scalability of the startups that join. We curate our programs to suit the needs of the ever-evolving and innovative entrepreneurs who need our support to get what they need.

Note: Parts of this article were written with the help of AI tools to enhance efficiency and reflect the advancements in technology’s role in content creation.

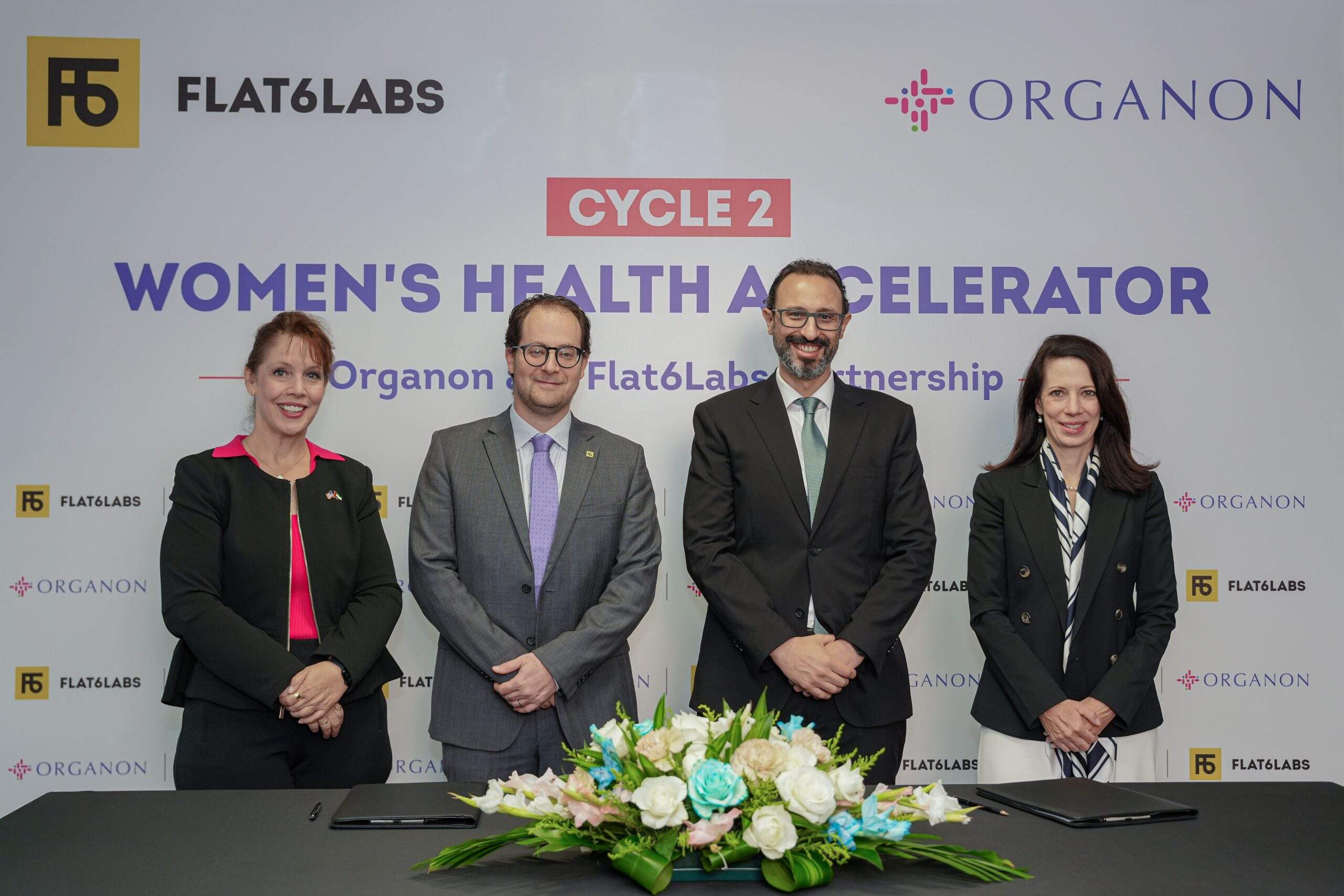

Organon and Flat6Labs Announce Second Cycle of Women’s Health Accelerator Program, Expanding Focus to Address Key Women’s Health Challenges Across MENAT

Celebrating International Women’s Day: Empowering Female-Led Innovation in Healthcare

Dubai, United Arab Emirates – 29 February 2024: Organon, a global healthcare company dedicated to improving women’s health, in partnership with Flat6Labs, MENA’s leading seed and early-stage venture capital firm, is thrilled to announce the launch of the second cycle of the Women’s Health Accelerator Program. Building on the success of the inaugural cycle and the incredible momentum witnessed across the region, this initiative aims to empower digital health startups with solutions to enhance women’s health across the Middle East, North Africa, and Turkey (MENAT) region.

The second cycle will hone in on three main focus sectors critical to women’s health:

Family Planning: Technologies Enhancing Contraception Counseling and Education and Awareness of Tools and Options.

Fertility Planning: Solutions for IVF Mental Health Support and Counseling.

Women’s Wellness: Innovations in Self & Maternal Care, Disease Prevention, and Menstrual Health.

The overarching objective of this accelerator program is to address specific challenges faced by women in the region concerning their health, aiming to find sustainable and long-term solutions. The focus will be on identifying and supporting digital solutions that can help improve accessibility, empower individuals, and enhance overall quality of well-being, ultimately advancing women’s healthcare in the areas identified. This year’s program will target startups operating in several countries, including Kuwait, Lebanon, Oman, Turkey, Egypt, Jordan, KSA, and the UAE. The majority of these countries have established Organon & Flat6Labs offices, with both entities having local partners in these geographies.

The initiative aims to accelerate the growth of 15 startups, and engage with various stakeholders, ultimately graduating startups that are ready to launch and address current challenges in women’s health. Additionally, the program will include virtual and on-ground community events such as info sessions, roadshows, pitchathons, and webinars to strengthen outreach, scouting, and selection efforts.

The second cycle of the Women’s Health Accelerator Program introduces enhanced program offerings. These offerings include:

In-Depth Training: Startups will receive specialized training in business and technical aspects, equipping them with the knowledge and skills necessary for success.

Mentorship and Guidance: Participants will benefit from mentorship provided by industry experts, connecting them to a vast network of local and international mentors, investors, and corporates.

Exposure to Stakeholders: Startups will have unique opportunities for exposure to key stakeholders, enhancing their visibility and creating valuable connections within the industry.

Regional Business Support: Access to a regional network across the region and support with market expansion.

Commenting on the program’s second cycle, Ramy Koussa, Associate Vice President, Organon, Middle East North Africa & Turkey (MENAT), stated, “Investing in women’s health shows positive return on investment (ROI): for every $1 invested, ~$3 is projected in economic growth. Investing in improving women’s health not only improves women’s quality of life but also enables them to participate more actively in the workforce and make a living. The potential value created through women’s higher economic participation and productivity exceeds the costs of implementation by a ratio of $3 to $1 globally. Launching the second cycle of the Women’s Health Accelerator Program marks a significant milestone in our ongoing commitment to advancing women’s health in the MENAT region. We are excited to deepen our partnership with Flat6Labs and continue listening to the needs of women, identifying innovative solutions that foster a better and healthier every day for her. This cycle is a testament to our sustained dedication to collaboration, innovation, and the empowerment of women-led startups in the digital healthcare space.”

Yehia Houry, Chief Programs Officer at Flat6Labs, emphasized the importance of supporting female entrepreneurs and advancing women’s healthcare, stating, “As we embark on the second cycle of the Women’s Health Accelerator Program, we are thrilled to amplify our support for female entrepreneurs shaping the future of women’s healthcare. This initiative is not just about innovation; it’s about empowering visionary minds to create lasting impact. Our ongoing partnership with Organon and the evolving focus of this cycle reaffirm our commitment to fostering a dynamic ecosystem for women-led startups. Together, we aim to revolutionize the healthcare landscape, ensuring it reflects the diverse and nuanced needs of women across the MENAT region.”

In the accelerator program’s first cycle, we witnessed the remarkable achievements of three standout startups that were announced as the winners: “OMGYNO” founded by Doreen Toutikian and Elisabeth Milini in Greece and Lebanon, “Siira” founded by Sandra Salame in Lebanon, and “Maternally” founded by Yasmin El Mouallem in the UAE. These visionary companies have not only demonstrated innovation and excellence but have also become integral parts of our ecosystem. As we embark on the second cycle, we are thrilled to welcome these winners back into the fold. Their invaluable insights, experiences, and successes will serve as guiding lights for the new cohort of startups, enriching the program with their expertise and contributing to its continued success.

For more information about the Women’s Health Accelerator Program’s second cycle and the application process, please visit our website here. The applications close on May 16, 2024.