- Home keyboard_arrow_right

- Events keyboard_arrow_right

- Survey Results: Key Insights About the Startup Ecosystem in KSA

Survey Results: Key Insights About the Startup Ecosystem in KSA Riyadh, KSA

Over the past few months, we conducted a survey to gain more insight about Saudi startups, including early-stage funding, specifically pre-seed funding, as well as the overall challenges facing the entrepreneurship ecosystem in KSA.

We gathered the responses of 100+ full-time startup founders in KSA, who shared their diverse experiences and perceptions throughout their entrepreneurial journey, and reached the following summary:

Challenges facing entrepreneurs:

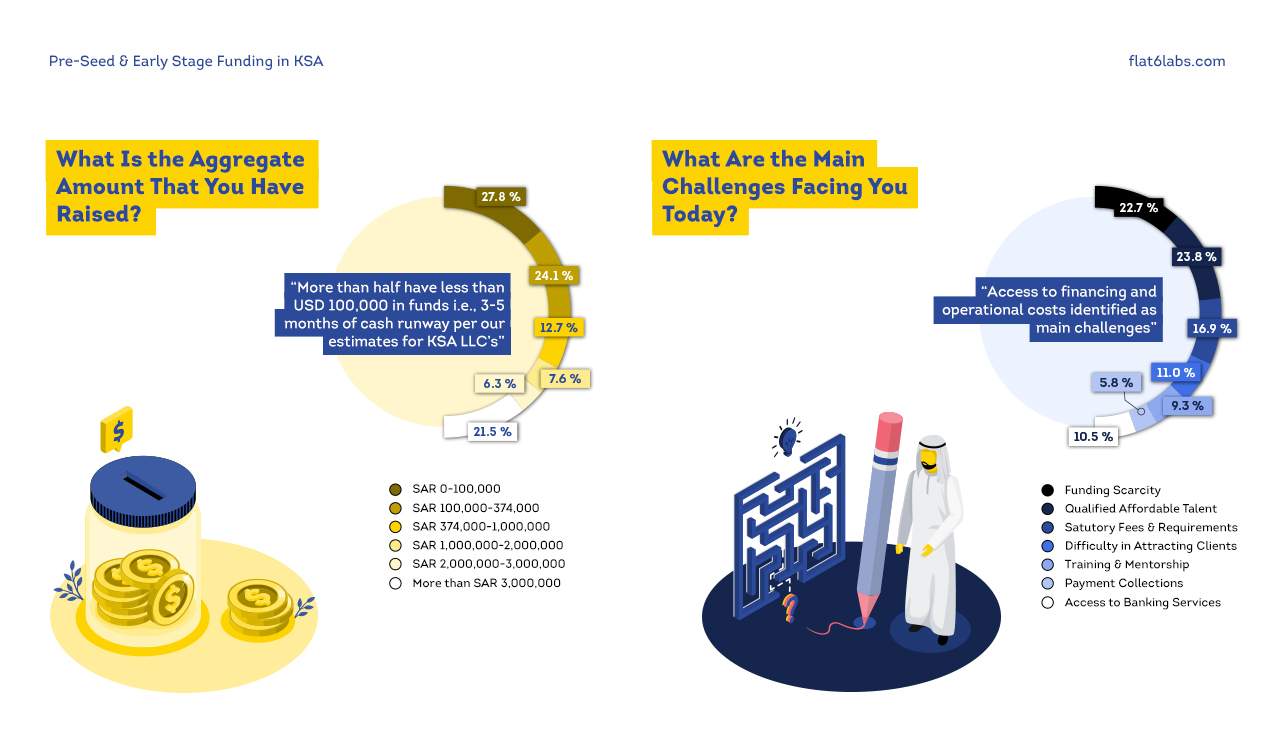

Among the many challenges that founders face, is the difficulty of securing the capital required to establish a startup in KSA. About 50% of the respondents were unable to raise funds or finance their startups through independent parties. Instead, they relied on their own funds and support from family members.

In addition to the high operating expenses, 50%+ of the startups, in the case that they actually succeed in securing funding, manage to secure no more than SAR 375,000. This amount isn’t sufficient in financing the operations of any business for more than five months. Based on our estimations, such an amount would often be sufficient to cover business operations for only 3-5 months.

It is worth noting that 17.2% of the participants managed to secure more than SAR 3 million in funding, notwithstanding the limited resources and funding amounts available to most participants. This may indicate that funding opportunities are only focused on some specific sectors.

The scarcity of qualified talent for reasonable wages can also be placed at the forefront of the challenges facing startup founders in KSA, where 23.8% of respondents expressed that they are experiencing difficulty in recruiting talent with the funding cap available.

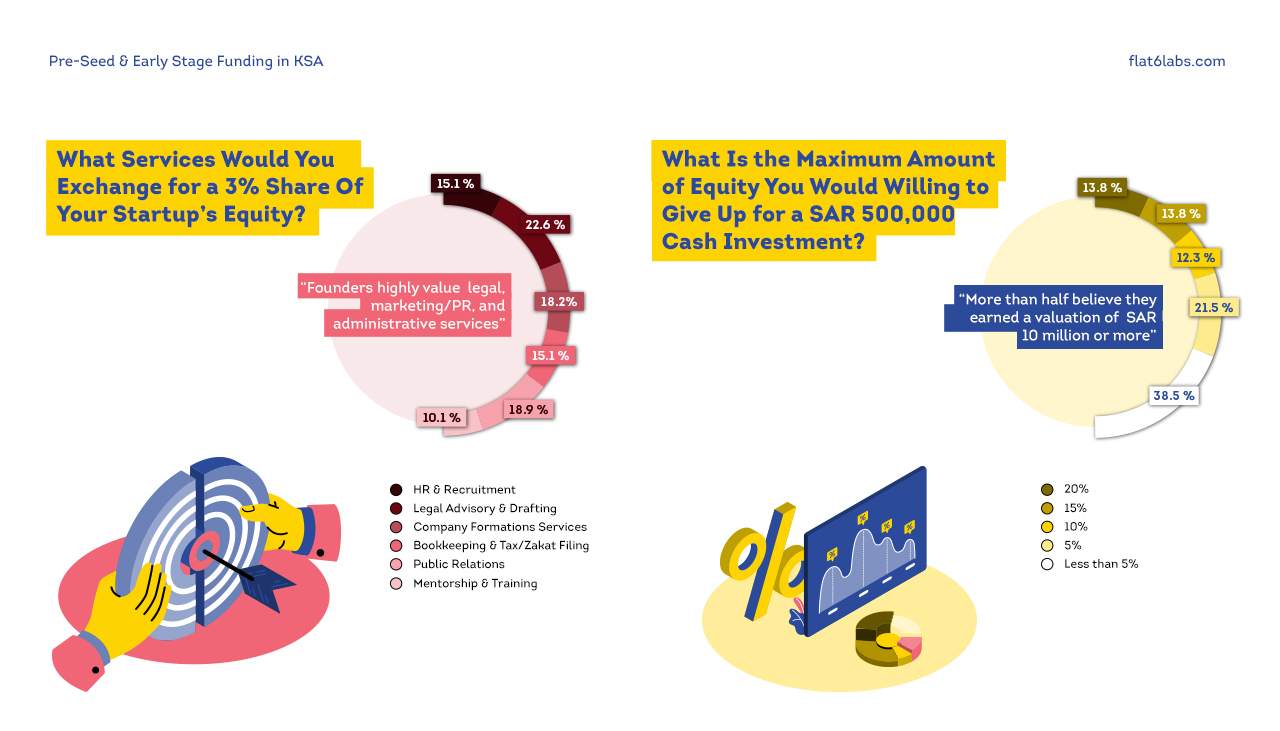

Furthermore, approximately 17% of the entrepreneurs participating in the survey have highlighted another challenge, mainly the statutory fees and requirements imposed by legislative bodies and authorities in order for them to be able to launch their businesses within a legal framework, which limits the opportunities for some startups. It is also worth noting that 40%+ of respondents cited legal, regulatory and PR services as an alternative to cash funding, in return for 3% of equity.

Funding Sources Available:

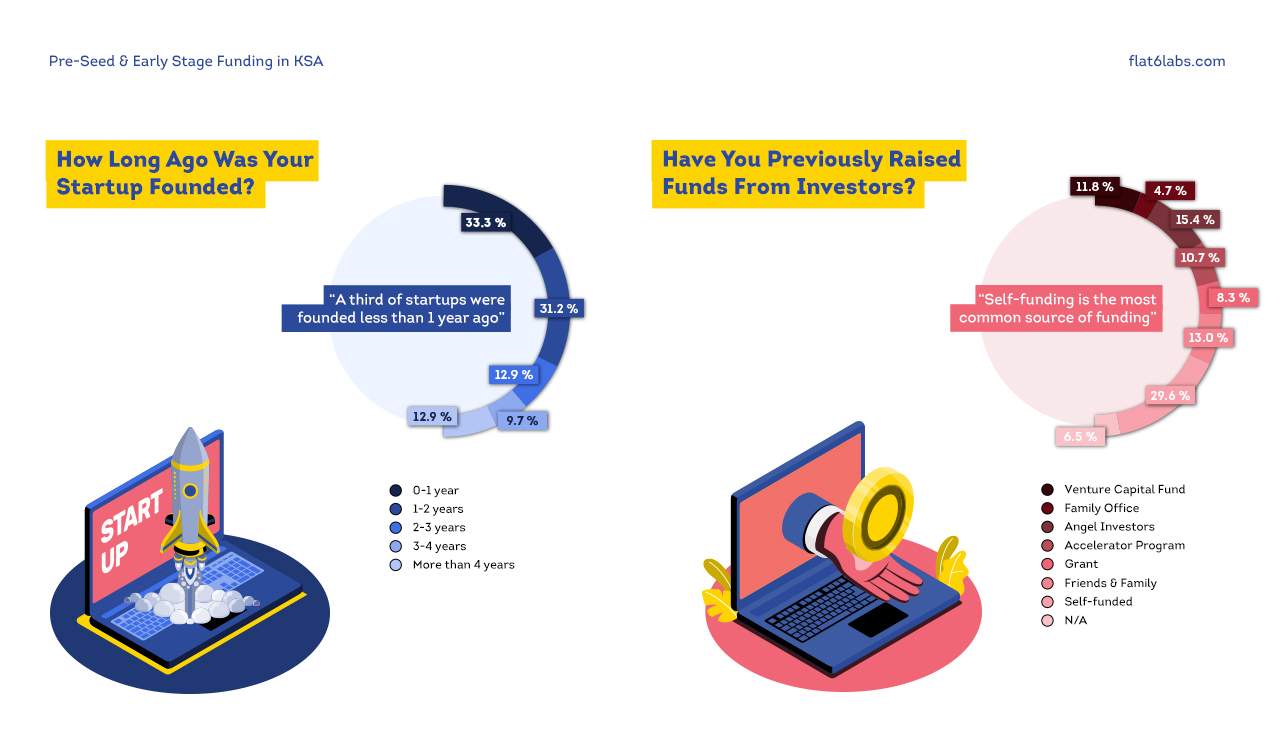

Due to the scarcity of funding sources for startups, self-funding is the most common source of pre-seed funding, which 30% of startup founders relied on. Angel investors rank first among independent sources of seed funding, at 15%, among other various independent sources that the founders often resort to at the beginning of their journey, such as business accelerators, venture capital funds, etc.

Startup Age:

According to the founders participating in the survey, one third of startups were founded within the past year, representing a positive reflection of the economic landscape in KSA, following the repercussions of COVID-19.

Product Readiness:

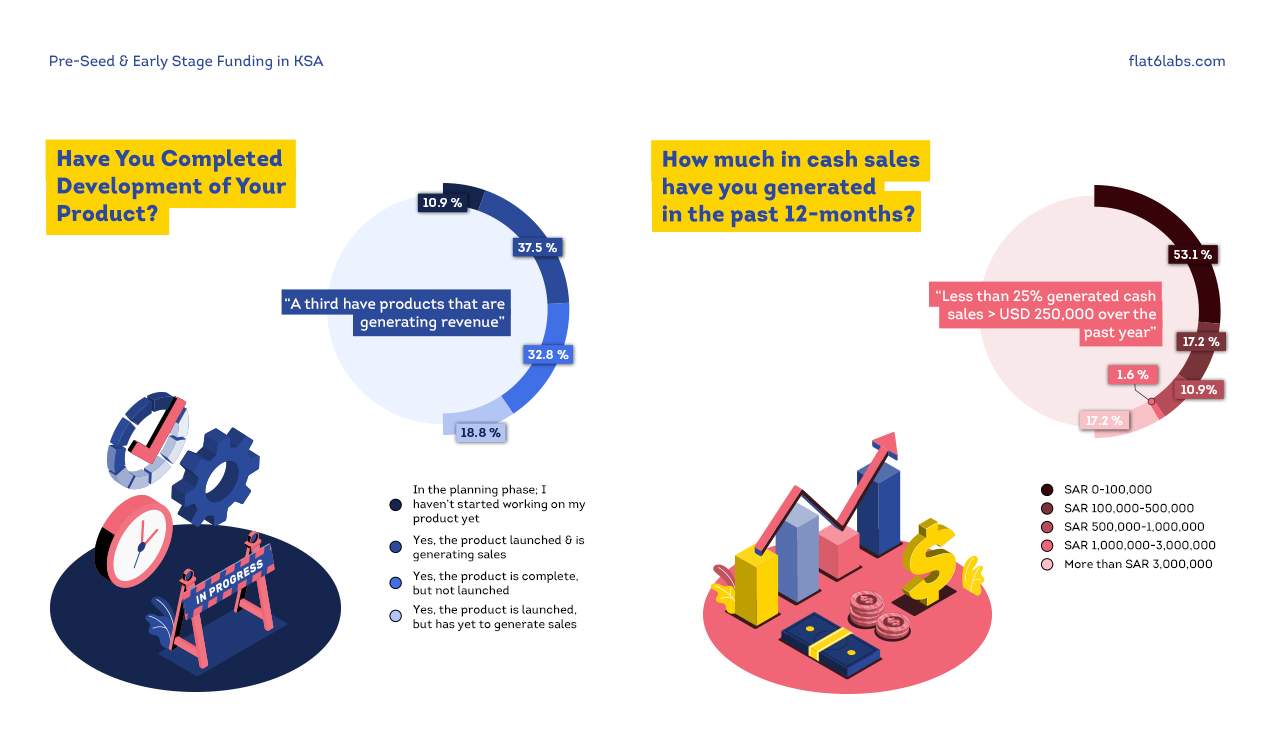

50%+ of the participating founders have developed and launched products that are customer ready with more than one third of the startups having generated sales upon introducing their products to the market. Moreover, 17% of the businesses managed to generate sales exceeding 1 million Saudi riyals within the past year.

Preliminary Assessment:

More than half of the respondents believe that their startups are worth SAR 10 million or more, and noted that they may be willing to give up only 5% of equity against SAR 500,000.

Looking to apply to our Riyadh Seed Program? Applications are open here.

arrow_back Back to all events